Another week in the LIBOR transition, another set of puzzling statistics. Over the last week (week ending 2022-02-18), the total volume in SOFR swaps has decrease by around USD 550 billions. On an relative basis, the share of SOFR swaps has increased by 3.48%, but the share of LIBOR swap has increased even more by 3.54%. The decrease in share is mainly attributed to EFFR.

Figure 1: Market shares for the different benchmarks at LCH in 2022.

Once more, the large LIBOR volume cannot be attributed to risk reducing trades. The outsranding LIBOR swaps have increase by USD 980 billions (USD 943 billions if we add IRSs and FRAs). The outstanding SOFR swaps have increased only by USD 952 billions.

Once more, we have some difficulty to interpret those figures in the grand scheme of the USD interest rate benchmark transition.

We are also adding the relative size of the new overnight benchmarks in the different currencies (GBP-SONIA, USD-SOFR, EUR-ESTR). The volume of SOFR is roughly at the same level as ESTR and SONIA (lower most of the weeks), even if of relative total volume year-to-date with respect to the USD, for EUR is less than 50% and GBP is less than 20%.

Figure 2: Comparison of weekly volume between SONIA, SOFR and ESTR.

Added 2022-02-22:

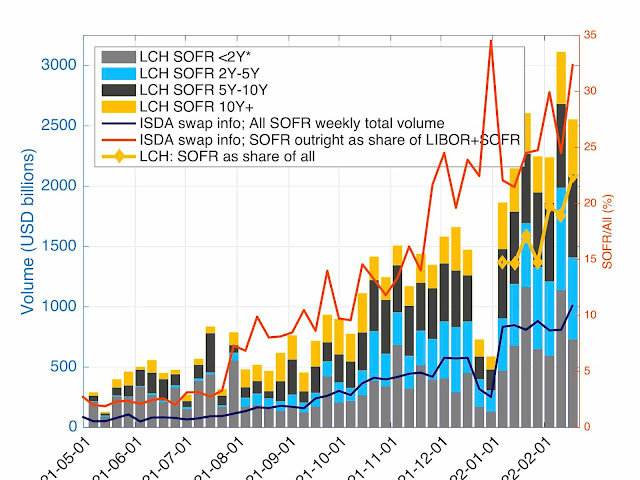

The US figures (as reported by ISDA based on US regulatory reporting) indicate a slightly different trend than the worldwide figures (as reported by LCH). In both cases, little change from one week to another, but US figures indicate a slight increase in SOFR and a slightl decrease in LIBOR while the worldwide figures indicate the opposite.

Figure 3: Weekly volume at LCH and as reported by ISDA.