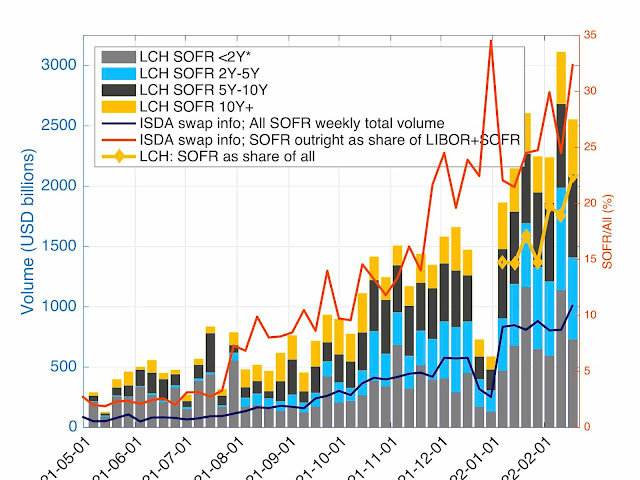

2022 was supposes to be the "no more LIBOR and SOFR First year". As described in our recent blogs, this has not been the case over the first weeks of 2022 for clear OTC swaps or for ETD futures. In both cases, LIBOR still largely dominates SOFR and in the cleared OTC case, even EFFR dominates SOFR.

Up to now we have not mentioned ETD STIR options (options on futures). The reason for the absence in our blogs was their absence in the market. This is changing.

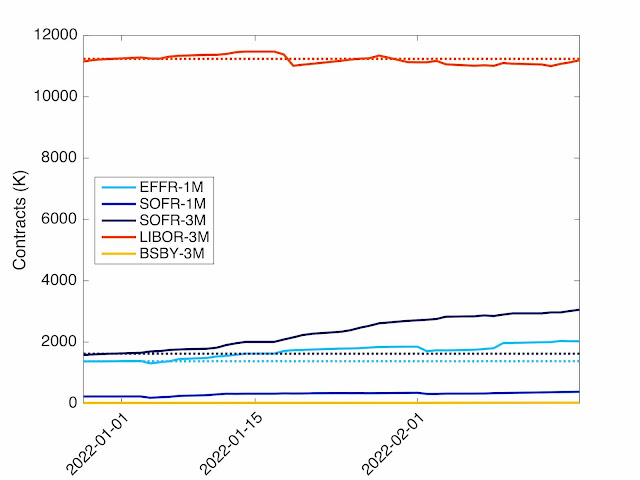

Over the last weeks, the volume of SOFR futures options has exploded, from completely invisible to barely visible. It may sound like an oxymoron to start the sentence with "exploded" and finish it with "barely visible", but the following graphs and figures will justify it. Let's start with the "barely visible" part in Figure 1. It represents the volume of some STIR options. In the different blue shades are LIBOR options and in the red/yellow SOFR options: we report only the main types: quarterly and yearly mid-curve (MC). The SOFR options represent 2.5% of the total over the past week.

Figure 1:Volume in some STIR ETD options since the start of 2022 (in thousands of contracts).

To justify the "exploded", we notice at the open interest (OI) in SOFR options has been multiplied by more than 100 since 3 January (from 7,772 to almost 800,000).

The volume shares for the week ending 2022-02-18 are LIBOR 97.5% (Quarterly 66.4%, MC 1Y: 21.3%, MC 2Y 6.1%, MC 3Y: 3.6%, MC 4Y: 0.1%) and SOFR 2.5% (Quarterly 1.5%, MC 1Y: 1%).

Like for the futures we have reported in the previous weeks, the LIBOR volume does not come from reduction of risk and removal of exiting positions. The OI in the different option types is provided in Figure 2 (same color code as above).

Figure 2: Open Interest in STIR ETD options since the start of 2022 (in millions of contracts).

The SOFR OI increase appears at the bottom of the figure and the even larger increase in LIBOR appears at the top. To show the increases in the different types, Figure 3 provide the OI change with respect to 3 January 2022.

Figure 3: Change in Open Interest in STIR ETD options since the start of 2022 (in millions of contracts).

The OI increase is visible for all types, with the quarterly LIBOR options pre-eminent. The increase in volume is probably in large part related to the expected changes in monetary policy in the US and its associated volatility and not related to LIBOR transition.

As usual a natural question is: Why trading LIBOR futures options? Most of the options will be converted at some stage before expiry to equivalent SOFR futures options. The products are for a large part SOFR options in disguise. Potential answers to the questions are:

- Ignorance: Participants do know about the coming transition.

- Lack of validation: Traders are perfectly aware that they are trading SOFR options but somehow the direct SOFR products are not accessible to them. This can be due to lack of model validation of the pricing of the SOFR products while the institution is still relying on a old (pre-transition) validation of LIBOR products. It can also be to lack of limits on those new products.

- Play on non-transition: Some players expect the LIBOR-SOFR transition in the futures and their options not to take place as expected (delayed transition, change of spread, legal issues, etc.)

- Liquidity: Liquidity calls liquidity. Because all the current liquidity is in LIBOR futures, nobody want to transact in SOFR products, even if they are equivalent, by fear of paying to much to enter and being stuck with the options without possibility to exit at a decent price.

Maybe we have missed on some other potential answers. Don't hesitate to send us your explanation, we will add them in the next blogs.

Our opinion about the potential answer above are:

- Ignorance: To our opinion, this is extremely unlikely and we mention it only for completeness.

- Lack of validation: SOFR futures products are technically more complex than LIBOR futures sue to the Asian feature of the final settlement price (price based on composition/average). Option on futures have a mixture of European option on an Asian futures. Not all participants may have included all those features in their validation process. Even if this is a likely scenario to our opinion, this should not be a satisfactory explanation. As soon as their was doubt on the LIBOR long term viability (i.e. from July 2017), model validation for all LIBOR products should have been invalidated as the products term sheets had changed. Today's validation of LIBOR options on futures is even more complex than SOFR options due to the transition complexity and its still uncertainty (at which date the transition will take place, at which price - spreads are not multiple of 25 bps - , etc.)

- Play on non-transition: This may be the explanation for some trades, but we expect this to be very minor and would certainly not explain the increase of OI by more than 6 million quarterly contracts.

- Liquidity: Certainly liquidity is an important characteristic of futures and their options. But in this case, as there is a quite clear transition mechanism, market makers could offer liquidity in the SOFR version, knowing that they can still hedge perfectly (up to the small transition mechanism uncertainty) in the LIBOR versions. The liquidity issue may have been an impact at the start, but so far in the transition process, this does appear to us as a real obstacle.

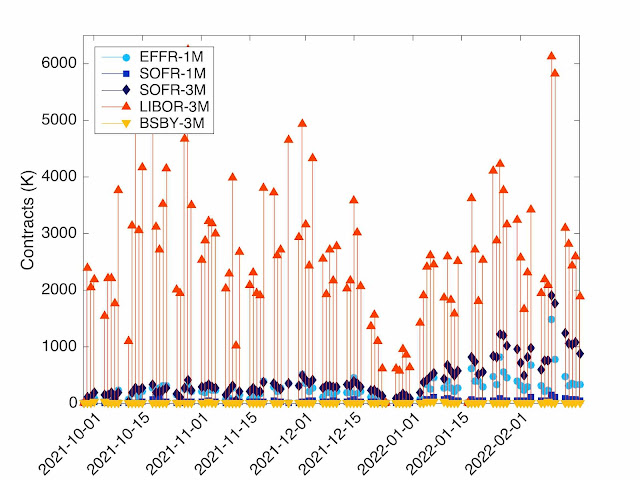

For the sake on completeness on our weekly review, we add the usual futures graphs. Like in previous weeks the summary is: same as last week. No change in LIBOR, small increase in SOFR.

For the week ending 2022-02-18, the shares are: LIBOR-3M : 63.2%, SOFR-3M: 26.1%, EFFR-1M: 8.9%, SOFR-1M: 1.7%, BSBY: 0.1%.

Figure 4: STIR ETD futures daily volume (in thousands of contracts).

Figure 5: STIR ETD futures open interest (in thousands of contracts).