Swap rate dependent products, e.g. CMS, have a long history in interest rate modelling. They look simple as only one rate is involved, but when the rate is not paid in a natural way, i.e. not according to its own annuity, they involve some type of "convexity" or "timing" adjustment.

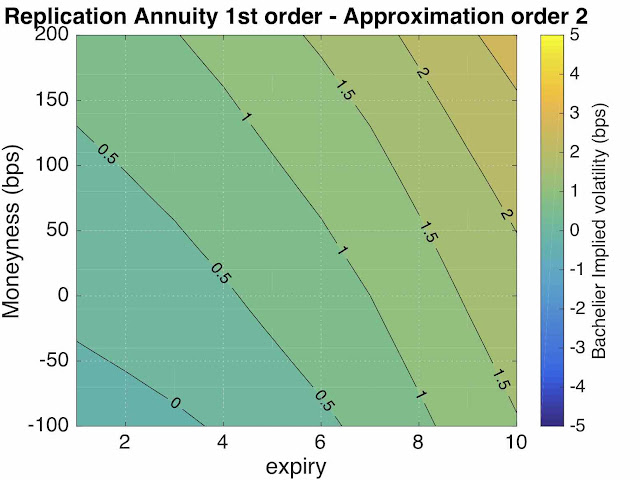

Those products are often priced using "replication", but to do so, some approximation of the annuity discounting, or absence thereof, is used. This type of single factor approximation is what we used in our recent paper on pricing cash settled swaption through the fallback published this month in Risk (Henrard (2022)).

A very recent paper Bang and Daboussi (2022) is proposing a new approach to price swap rate dependent products in a way that preserves the full marginal distribution of all the swaps and a user selected copula between those rates.

The implementation is not trivial from a quantitative finance perspective (two changes of measure) and implementation (Monte Carlo). But by the way the numerical approach is cleverly designed, the simulations are not too costly and converge quickly.

We have adapted the methodology proposed by the authors to take into account conventions (accrual factors not all the same and the T+2 payment/effective date) and implemented it in our library. This is the library we use for consulting and model validation purposes.

The results we have observed are very good. In their paper, the authors compare the (input) market smile to the (output) model generated smile for vanilla options and find a very small discrepancy, i.e. the numerical noise is small on the present value. We have obtained the same results. We have also done the comparison for the smile risk which was not presented in the paper. We computed the sensitivities to the alpha, beta, rho and nu parameters in a SABR model. In our implementation, the sensitivities are obtained by Algorithmic Differentiation (AD) as you would expect. For a 2Yx5Y swaption, here is the comparison between the analytic result (direct formula for the vanilla) and the Monte Carlo with AD version:

As you can see, the numerical noise is below 0.05% of the actual number on the alpha-vega (a little bit higher for nu and rho). This was obtained with a relatively low number of Monte Carlo paths (1,000).

Why we are interested by this approach, beyond its natural application to CMS, is for the above mentioned fallback of cash settled swaptions with the LIBOR-linked swap rate discontinuation.

With a precise view of the term structure smile risk in CMS-like products, we can now have a look at term structure smile risk for the fallback. That will be the subject of a forthcoming blog.

Henrard, M. (2022). Swap rate: cash settled swaptions in the fallback. Risk, Cutting Edge. Published online 1 July 2022. https://www.risk.net/cutting-edge/banking/7951001/swap-rate-cash-settled-swaptions-in-the-fallback

Bang, D. and Daboussi, E. (2022). Modelling of CMS-linked products in an RFR framework, with extension to hybrids, forward starting and canary options. SSRN 4134438. https://ssrn.com/abstract=4134438

Don't hesitate to contact us if you are interested by model developments or model validation related to swap rate linked products like CMS.

Added 2023-05-07: The implementation notes for this model have now been published in the muRisQ Advisory Implementation Notes series. See the new related post.