The paper on the swap rate fallback and its impact on cash-settled swaptions announced in March has now been published in Risk.

Swap Rate: cash settled swaptions in the fallback

The paper is available on the Risk web site at

Abstract

With the planned cessation of LIBOR, the LIBOR-based Swap Rates will also cease. For legacy transactions linked to it, a fallback is required. Some approximated fallback mechanisms have been proposed by working groups. The approximations involve some non-linear function of overnight-based swap rates. Due to the non-linearity, cash settled vanilla swaptions are becoming exotic products. Moreover, keeping the annuity unchanged while changing the rate to overnight-based swap generates technical issues in the pricing leading to convexity adjustments. The article proposes different pricing methodologies for those now exotic swaptions, including several price approximation to reduce the implementation numerical complexity.

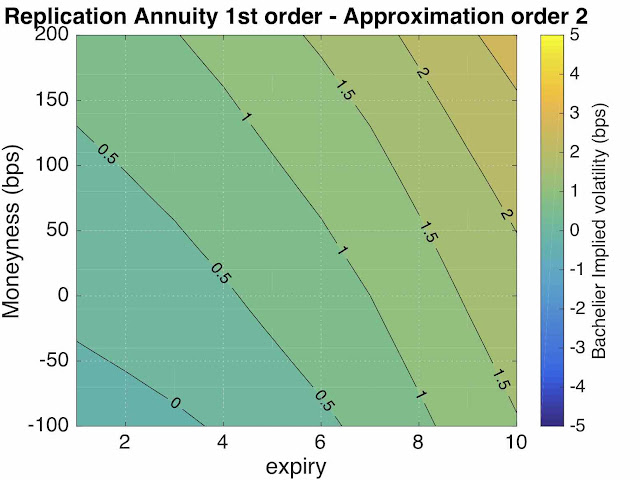

One graph from the paper: Error between replication with annuity ratio and order 2 approximation.