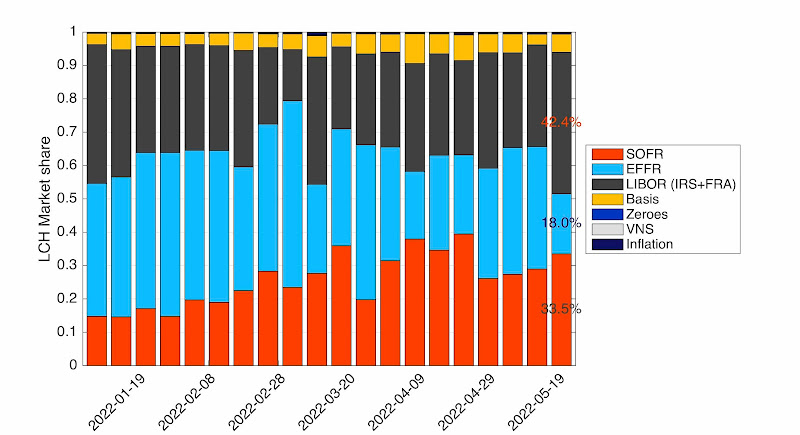

We are six months into the "now new USD-LIBOR risk traded" period as announced by regulators. We had a look at the situation through the eyes of the STIR futures market at CME.

USD-LIBOR futures have been the most liquid STIR futures for many years. The new SOFR futures and the "SOFR First" initiatives should have shifted the volume.

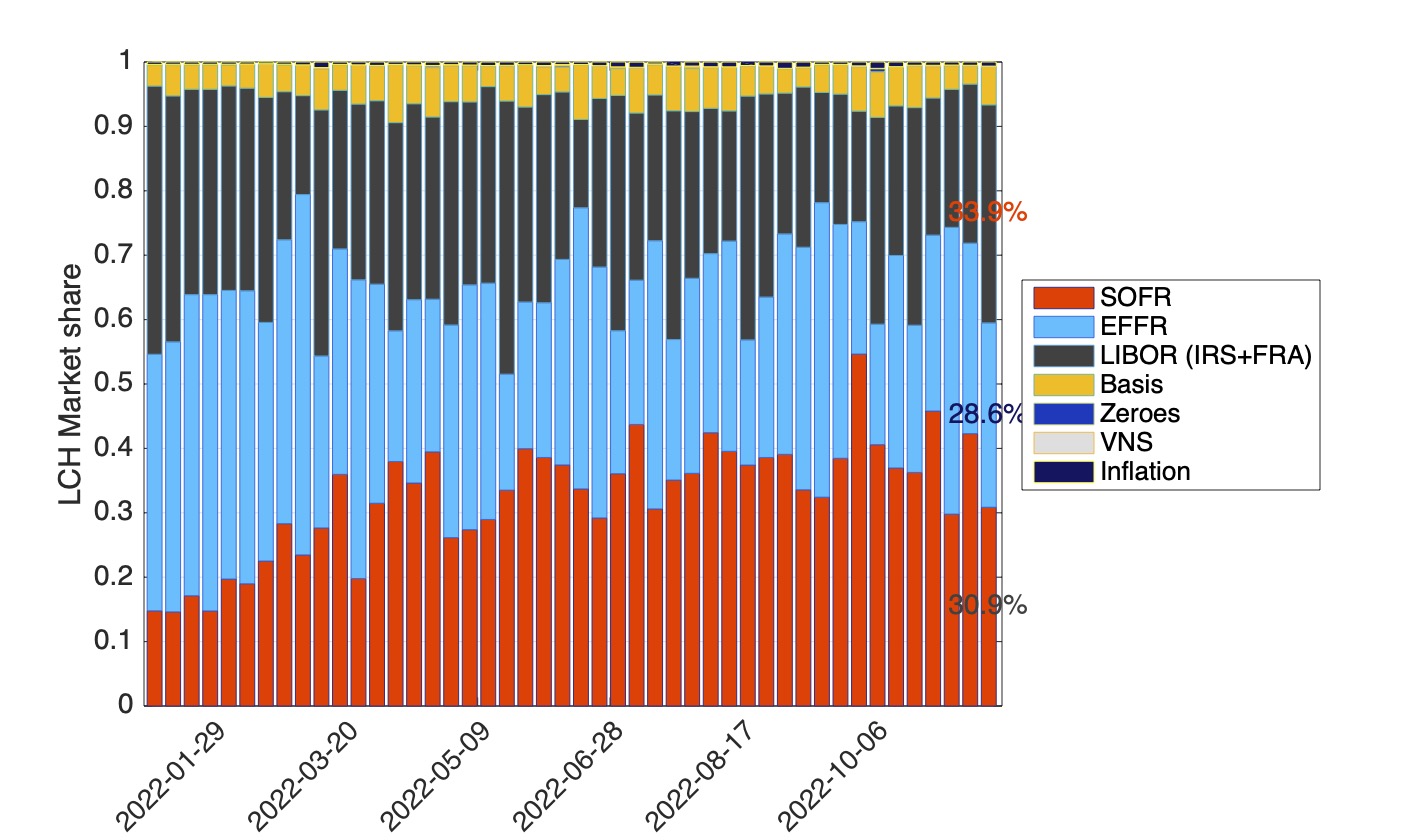

In Figure 1, the daily volume at CME is displayed. One can see that SOFR-3M futures have now a higher volume than LIBOR-3M futures. But this is a recent phenomenon that appeared only in May and the advantage of SOFR is small. Over last (short) week, the SOFR volume as only 20% higher than the LIBOR volume.

Figure 1: Daily STIR Futures volume at CME.

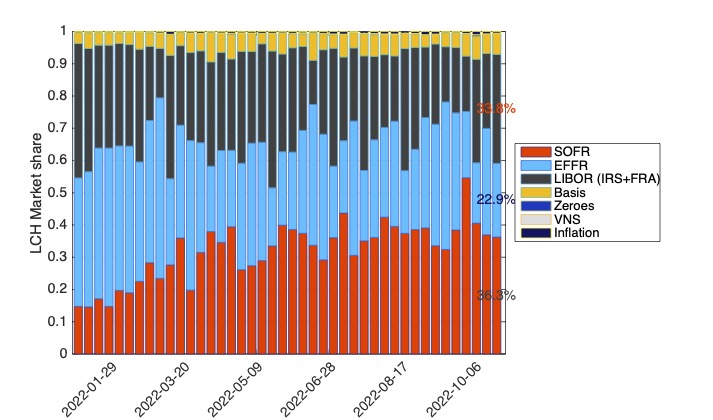

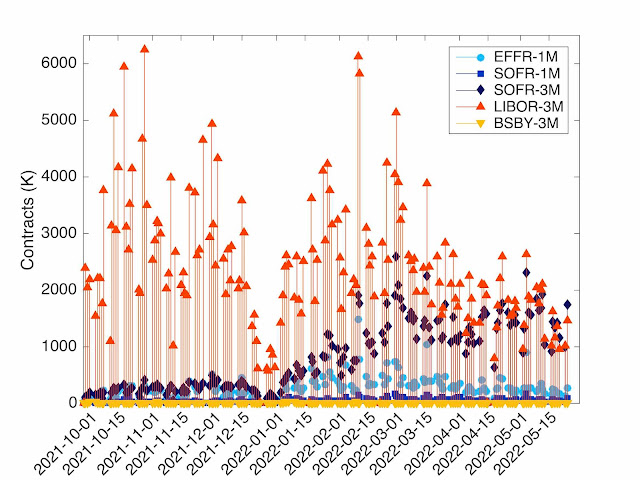

On the open interest side, LIBOR is still largely above SOFR with an excess OI of 75%. More details are displayed in Figure 2. Moreover LIBOR OI as only decreased slightly since the start of the year, from 11.2 m contracts to 9.6 m (-16%). A large part of the decreased came when existing contracts came to expiry. Since the beginning of the year, the total LIBOR futures volume has been 265.8 m contracts. The decrease in OI correspond to 0.7% of the traded volume. We are extremely far away from a situation were the new LIBOR trades are risk reducing!

Figure 2: Open Interest in STIR Futures.

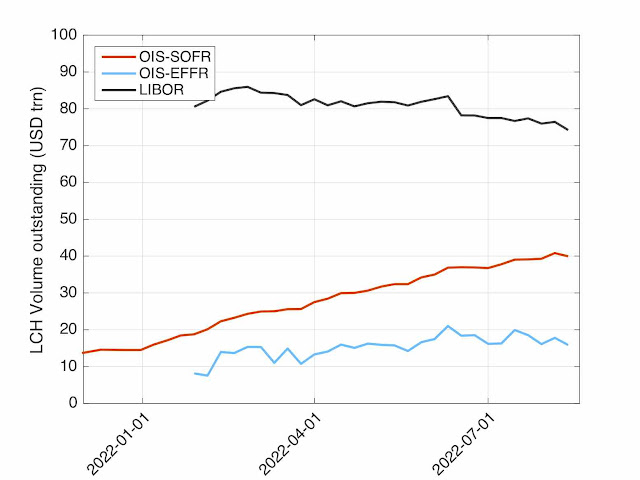

Another feature of the futures market is the expiry date of the contracts traded. LIBOR with cease in June 2023. One could claim that trading LIBOR contracts with expiry before that date make sense from a risk management perspective and is in line with the spirit of the SOFR first requirement in the sense that those trade do not add to the transition effort which is not needed before June 2023. But the expiry profile of the futures traded does not look like that at all. If we take the traded volume for quarterly contracts on Friday 24 June, we get a expiry profile displayed in Figure 3.

Figure 3: Daily volume on 24 June 2022 for the different quarterly expiries.

The SOFR-3M futures are dominating overall, but for the maturities beyond June 2023, LIBOR is dominating. The higher LIBOR volume is even more important on a relative basis for longer expiries. If we take contracts with maturity beyond 5 years (June 2027 and beyond), the LIBOR volume is 27 times higher than the SOFR volume. Is there some market participants betting on the transition not taking place in the next 5 years?

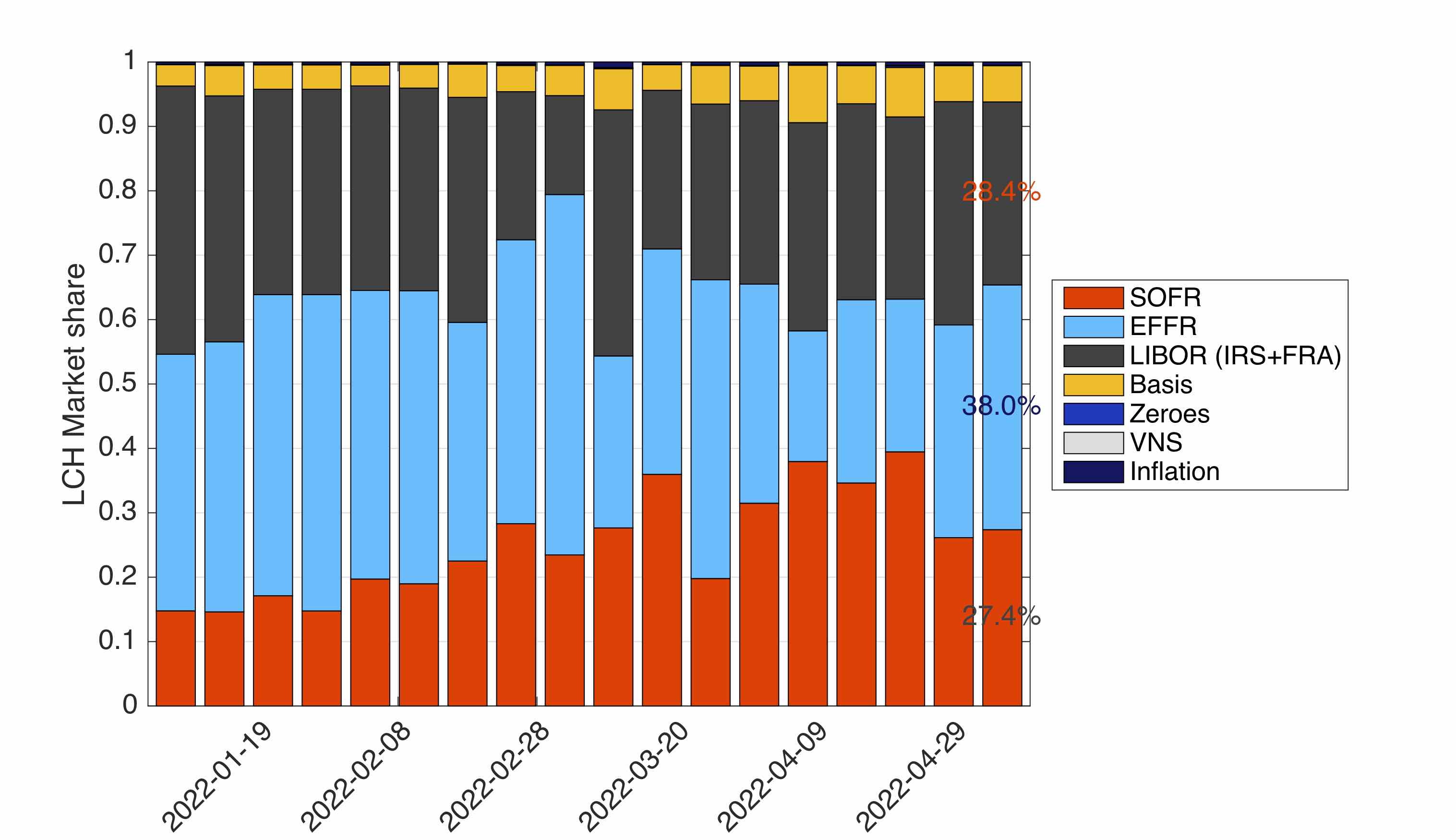

This leads to a question we have asked for some time, without finding an answer. Or more exactly finding plenty of answers, but all bad (and scary) answers. The question is

Why do financial institution still trade LIBOR futures/swaps?

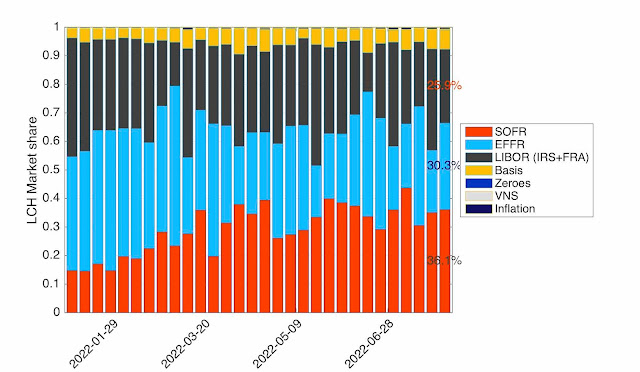

In the different seminars on SOFR that we are presenting, we use the following slide to put the question in perspective.

Figure 4: Why do financial institution still trade LIBOR futures/swaps?

- Investment universe. SOFR products not approved by the investment committee.

- Validation Model. validation had no time to do a full validation of the new products.

- Systems. The system (risk/accounting) cannot cope with the SOFR products / the composition in-arrears.

Those reasons are valid reason from a very short term practical perspective, but certainly not valid 5 years after the "Future of LIBOR" speech by FCA, 4 years after the creation of SOFR and 1 year after one knows about the actual cessation date. It can take time to change systems, guidelines and validate changes. But by trading LIBOR products, you are only lying to yourself and hiding your weakness to yourself, not solving any of them. At the very least I would expect participants to trade the real think (SOFR swaps and futures), without frankensteins-like fallback, and book/report them in the best way they can. That could simply be to create swaps/futures linked to SOFR term rate (same system complexity as LIBOR) and adjust the booking as soon as possible. At least you will represent the bulk of your risk correctly and link it to SOFR!

Don't hesitate to contact us for advisory work related to the transition, the associated model developments, validation, or implementation.