More than 5 years after the "Future of LIBOR" speech, almost 18 months after the announcement of the definitive LIBOR dismissal and more than one year after the SOFR First announcement; LIBOR is still traded in huge amounts. Only for last week LCH cleared IRS, there was 1.3 trillions USD traded.

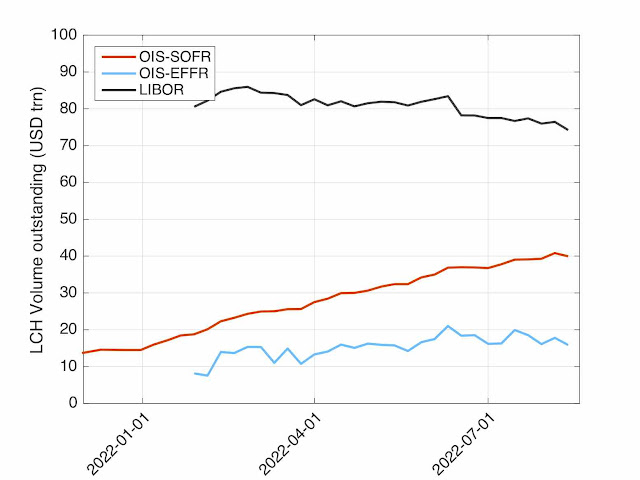

But we see a slow progress. LIBOR volumes and outstanding notionals are slowly trending downward with some ups and downs; SOFR volumes and outstanding notionals are slowly trending upward with some ups and downs.

Figure 1: Weekly share by product types at LCH

Speaking of outstanding amount, the SOFR outstanding amount at LCH has decrease last week by 895 billions, the highest decrease ever. Nothing to be afraid of as there is a lot of short term products and they come naturally to maturity. But it may mean that we are approaching the "SOFR" peak. Note also that in term of outstanding amounts, SOFR is still well behind LIBOR with a 40 v 74 (trillions) score.

Figure 2: Outstanding amounts by benchmarks at LCH

Note that the "CME Conversion for USD LIBOR Cleared Swaps" rules have just been published. It means that since 2017, the market has been trading instrument linked to LIBOR, knowing that LIBOR would disappear and is only learning now what it has been trading for the last 5 years! Not a big success in term of transparency.