It is difficult to get a clear message from a market which is half in holiday and half in recession. From the SOFR market, we could say, once more, nothing special to say.

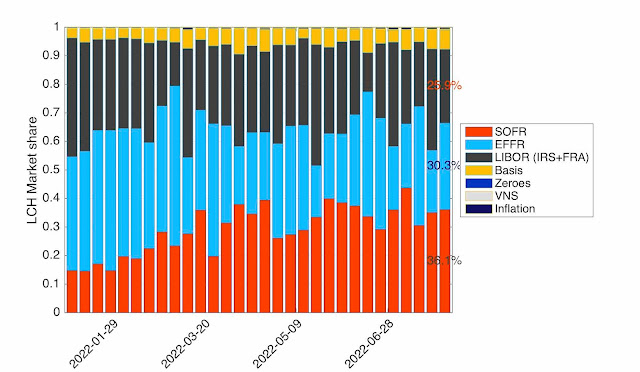

The share of SOFR in the LCH cleared OTC IR market is playing ups and downs around one third of hte market. The changes are as much related to LIBOR and EFFR as to SOFR. The current SOFR share is not very different from the one mid-March.

Figure 1: Weekly share by product types at LCH

On the absolute volume, the holiday mood is clear, with the current weekly volume at merely 62% of the mid-June volume.

Figure 2: Weekly SOFR volume at LCH and as reported by ISDA (US regulatory figures based).

On the subject of LIBOR transition, we looked at the outstanding notionals at LCH in the different currencies. We noticed again a relation between the transition to overnight rates and the total outstanding notionals. Since the beginning of the year, all the currencies that have fully transitioned (GBP, CHF, JPY) have seen significant decreases (GBP -15%, JPY -42%, CHF -37%), the currency that has half transitioned (USD) is almost stable (+3%) and the currency that has not transitioned at all (EUR) has seen a significant increase (+19%). The origin of this relation is not clear. It can be completely random, or it can be that the end users have decrease their risk management program as the new overnight world does not fit their needs, or it can be something else. But certainly a trend to check in the future.