We start this week with a LCH consultation regarding the Conversion of Outstanding Cleared USD LIBOR Contracts. No big surprise in the content of the consultation itself. It is roughly the same a proposal for USD in June 2023 than the one for GBP in December 2021.

But this consultation is also the occasion to remember the uncertainty surrounding cleared LIBOR trades, the OTC versions at LCH and CME but also the ETD futures versions at CME. Each trade involving a LIBOR fixing beyond June 2023 need a precise fallback. The cleared trades don't have a precise fallback yet. The existence of the consultation, almost 5 years after the "Future of LIBOR" speech, is a reminder that the transition is still unplanned. The figures below illustrate that LIBOR still attracts more volume than SOFR. But a lot of those LIBOR-linked trade are for an unknown term sheet.

The cleared swaps term sheet can be modified unilaterally by the CCPs using unknown mechanisms. The LIBOR futures will be transformed into SOFR futures at an unknown date and with unknown mechanisms. Yes, those mechanisms have been roughly described and there is an expectation that there will be little modification of them. But remember, for the ISDA definition, there was a consultation and then after the results were announced, the actual meaning of the different fallback mechanism was decided by Bloomberg! For cleared GBP swap at LCH, it was announced that the ISDA mechanism would be copied, only to decide later that a different mechanism would be used.

As model validators, we don't understand how the trading of Eurodollar futures or cleared LIBOR swaps can be validated from a quant perspective when the exact term sheet is still unknown.

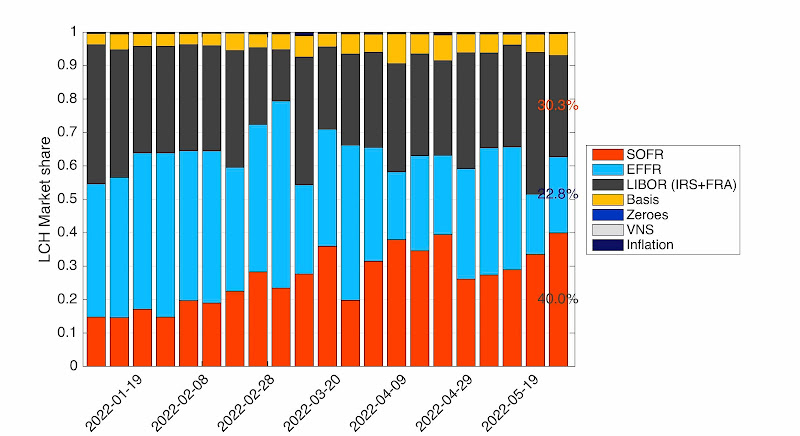

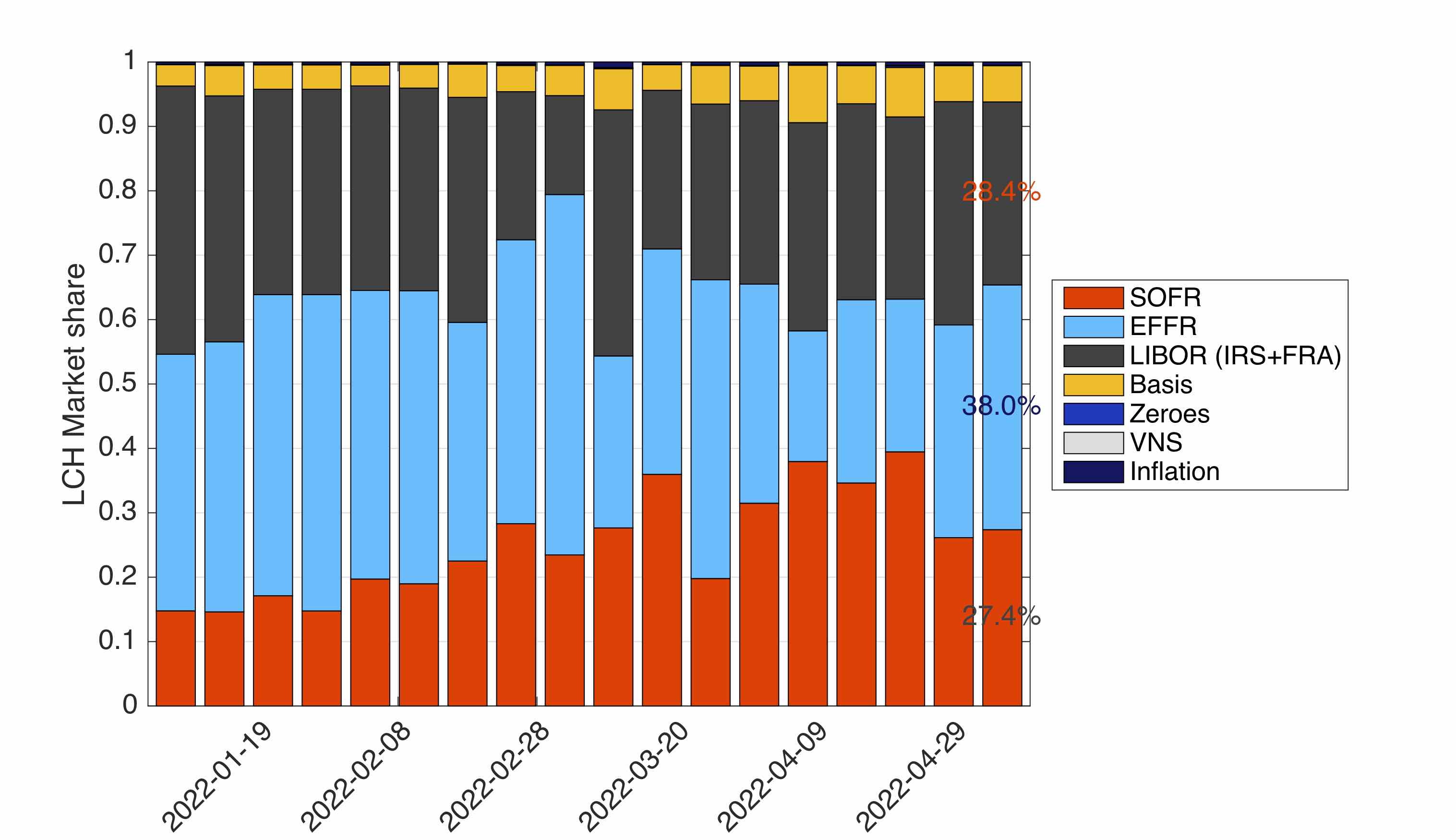

Coming back to our weekly statistics, we see that at LCH, from a volume perspective, SOFR is still third. Five months into 2022, we certainly have not achieved "SOFR First" in a stable way.

Figure 1: Weekly share by product types at LCH

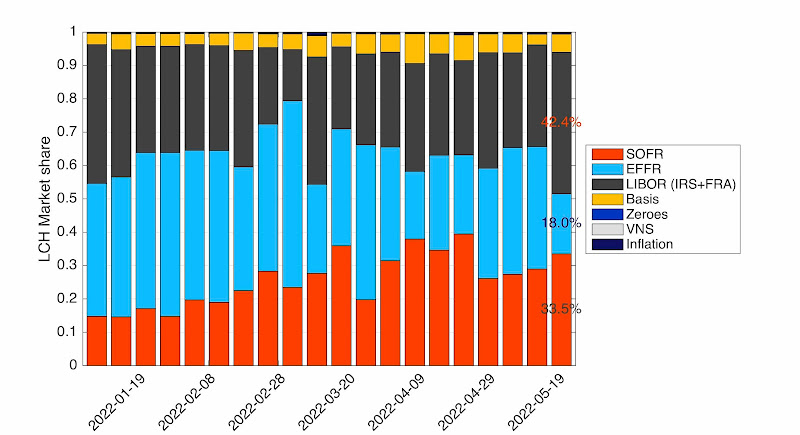

Last week, the SOFR relative volume was around 29.0%. It has been lower than both the LIBOR and the EFFR volumes for several weeks now. On an absolute basis, the volume has not been increasing either. Last week volumes at LCH and as reported by ISDA are lower than the one reported in February as displayed in Figure 2.

Figure 2: Weekly SOFR volume at LCH and as reported by ISDA (US regulatory figures based).

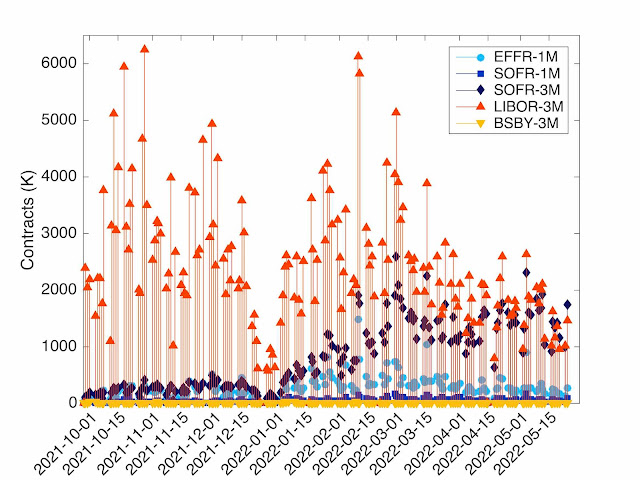

The futures do not paint a very different picture. The volume of LIBOR-3M futures is still above the volume of SOFR-3M futures each and every day, as displayed in Figure 3.

Figure 3: Daily futures volume at CME.

The activity in LIBOR futures is certainly not all risk reducing as regulators would like. Since the beginning of the year almost 222 million LIBOR futures contract have been traded. Over the same period, the open interest in the same futures has decreased by a pale 660,000 contracts. A maximum of 0.3% of the trades are risk reducing. We say "maximum" as a certain amount of trades expired on a monthly basis — we don't have the expiry figures so cannot adjust the above figure.