A couple of months ago, we announced that the research paper written by Marc and titled

Swap Rate: cash settled swaptions in the fallback

had been accepted for publication in Risk. The article will appear in the June edition.

Since, that research has been deepened and we are pleased to announce that the follow-up article has been already accepted for publication in Wilmott Magazine. The article is titled

Swap Rate fallback: unreasonable effectiveness of approximations and alternatives.

Abstract

Cash-settled swaptions with collateral discounting are impacted by the Swap Rate fallback mechanisms decided by working groups/ISDA. The legacy vanilla swaptions are becoming exotic products, as the mechanism is based on a non-linear transformation of the OIS swap rate, and generate convexity adjustments. It turns out that those two effects almost cancel each other and lead to almost vanilla products. We analyse those cancelling effects and the risk management impacts. Based on those insights, we propose an adjusted fallback mechanism that reduces further the exotic features and simplify further the risk management of the legacy book.

The article should be published in the September issue.

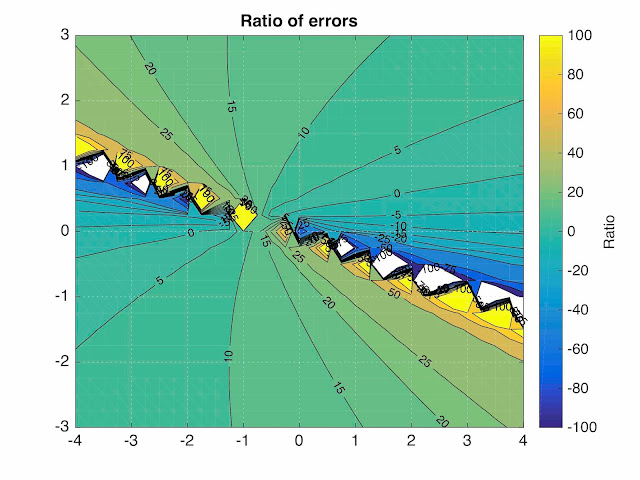

As a teaser, the graph below describes by which factor the "exoticness" of the fallback is reduced by our proposed alternative mechanism for different market movements. All the technical details are available in the paper.

Figure 1: Reduction in "exoticness" achieved by the alternative fallback proposal.

The summary of the results related to the alternative fallback method and the research paper have been communicated to the ARRC.

Added 7 June 2022: A preprint version is available on SRRN at: https://ssrn.com/abstract=4130090.

Don't hesitate to contact us if you are interested by the alternative to the ISDA fallback for swap rates. Cash settled swaption fallback can be a lot simpler than the current approach. Why not simplify your transition risk at no cost?