Big increase in LIBOR OTC swaps volume this week!

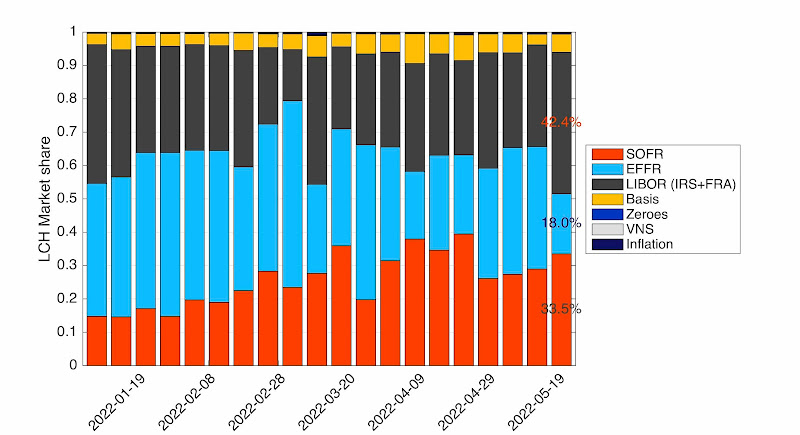

Figure 1: Weekly share by product types at LCH

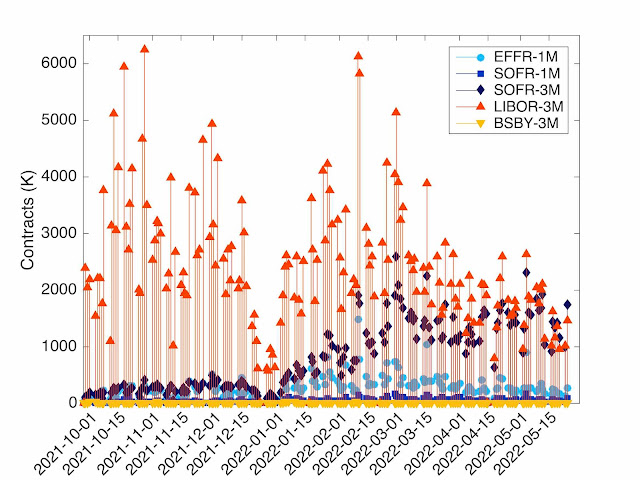

But on the futures side, we had, for the first time, a couple of "SOFR First" days last week from a volume perspective. The volume of SOFR-3M futures has been above the volume of LIBOR-3M futures from Wednesday to Friday (see Figure 2). The SOFR First is only in terms of volume, not in terms of open interest. In OI terms, SOFR-3M futures represent 50% of LIBOR-3M. Actually the 50% treshold was reached on Tuesday 24 May and now stands at 50.02%!

Figure 2: Daily STIR futures volume at CME.

The open interest for LIBOR-3M futures is decreasing very slowly. Since 31 December, the OI has decrease only by 7.2%. Note also that the total volume (SOFR+LIBOR) is significantly lower than previous peaks. It is not clear if this is structural or conjectural. But with uncertainty about monetary policy path, one could have expected a larger volume.