The proposed

IBOR Fallback Rate Adjustments Rule Book has been published by Bloomberg.

The exact details of the fallback from IBOR to compounded setting in arrears seems slightly different from the version in the latest ISDA consultation. In particular the compounding period is back from the "calculation period" to the IBOR tenor period. The period is defined with an "offset by 2 business days".

In this post, we look at the precise description of the "offset by 2 business days" as its implementation may be different from an intuition of such an offset.

The composition period is defined, first by moving froward from the fixing date by two business days to the spot date. The move forward is in the calendar of the replacing overnight index. For USD, this is already a little bit tricky as for LIBOR the fixing is in GBLO calendar, the effective date is in GBLO and USNY calendar but SOFR is fixed in the USGS calendar. We skip this question of calendar here. From the spot date, the start accrual date for the composition is computed by moving backward by 2 business day, this is the "backward offset by 2 business days" from the consultation. The end accrual date for the composition is computed from this start accrual date by adding the tenor of the IBOR index. For tenors in months, the end date is adjusted modified following.

The feature of this approach is that the backward offset is done on the start date and the end date is recomputed from the start date. Due to non-good business days, week-end in particular, there is no guarantee that the end date for the composition will actually be before the end date of the coupon period. In many cases there will be a same day payment. One example is described in the post

Fallback and same day payment?.

In this post we want to focus on the impact of the way the offset is computed on the overnight risk. Because each compounded period for consecutive coupon of a swap is computed with its own offset, there is no guarantee that those periods will fit nicely next to each other. In

another blog commenting on the fallback rule book, we mention one such example.

Having added the new fallback rule in our

Fallback Transformer library, we can now look at the impact that those periods not fitting exactly has on the risk. Here the risk is a lot more complex that for LIBOR as each day counts, and with SOFR showing spikes at month-end, quarter-end or 15th of the month, the exact day is important.

We use the same example as the one described in the above mentioned blog: Example 1M-IBOR swap over 5-month period: 2020-03-26 to 2020-08-26. The standard accrual periods for the coupons payments are on dates 2020-03-26, 2020-04-27, 2020-05-26, 2020-07-26, 2020-07-27, and 2020-08-26. The accrual periods for RFR compositions (with 2 days offset) are [2020-03-24, 2020-04-24], [2020-04-23, 2020-05-25], [2020-05-22, 2020-06-22], [2020-06-24, 2020-07-24], [2020-07-23, 2020-08-24].

We look at the risk of the swap resulting from the fallback and the risk of a standard OIS starting on 2020-03-24 and ending on 2020-08-24. With those dates, the OIS has exactly the same start and end date as the OIS composition resulting from the fallback. This is true at least at the total swap level. What is happening at the coupon level?

The coupon level is described in the next two graphs. The first one is the OIS risk. In the graph, we represent only the risk associated to the forward rates (not the discounting, which is very small). We look at the risk at the (zero-coupon) rate daily sensitivity, not through a standard Bucketed PV01. The daily feature is important to understand the difference between the two instruments. The risk is viewed from 2018-08-30, this date is not important, it turns out this is the date used in previous blogs.

The swap has a notional of 1 million. Its effective date is roughly 19 months after the valuation date and the maturity date roughly 24 months after the valuation date.The risk profile is exactly what you expect. A large risk at the start, with a value of roughly 1,500 USD/bps and a large risk at the end, with a value of roughly 2,000 USD/bps in the opposite direction. Each coupon payment has a very small risk which would be cancelled by discounting risk.

The profile of the swap resulting from the fallback is a lot more interesting. Due to all the adjustments related to week-ends, the end of one coupon compounding period does not match the start of the next coupon compounding period. In this particular case, each coupon creates large positive and negative exposures at slightly different dates. In some case, there are overlaps between the periods and in other cases, there are gaps between them. Counting positive days for overlaps and negative days for gaps, we have at the 4 intermediary dates, 1, 3, -2, and 1.

Market makers will need to adapt their tools to deal with those gaps. Also, those gaps will not be completely random. Some week-ends will be more favorable for gaps and some more favorable for overlap. You cannot expect a large book to smooth those features out, to the opposite, a large book with not perfectly offsetting trades will tend to accentuate those features.

Note added 2020-05-31: A similar analysis on a large portfolio is available at Fallback transformers - Gaps and overlaps - portfolio version.

- Fallback transformers - Introduction

- Fallback transformers - Present value and delta

- Fallback transformers - Portfolio valuation

- Fallback transformers - Forward discontinuation

- Fallback transformers - Convexity adjustments

- Fallback transformers - magnified view on risk

- Fallback transformers - Risk transition

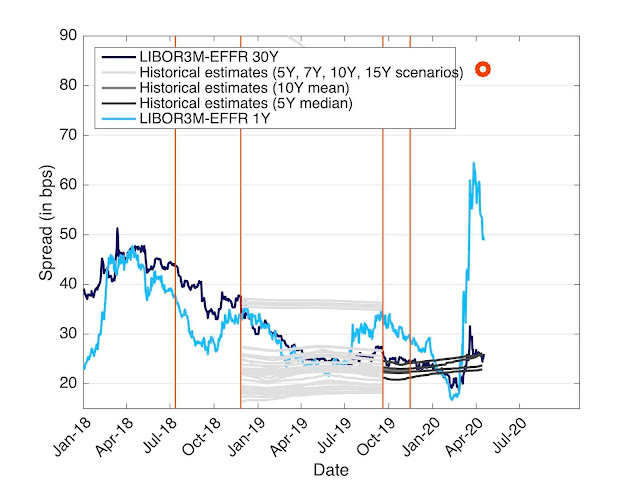

- Fallback transformers - Historical spread impact on value transfer

- Fallback transformers - A median in a crisis

- Fallback transformers - Gaps and overlaps

- Fallback transformers - Gaps and overlaps - portfolio version

Don't fallback, step forward!

Contact us for LIBOR fallback and discontinuation: trainings, workshops, advisory, tools, developments, solutions.