The post title may sound a little bit oxymoronic. It is not the fault of this author but the fault of the regulators and the market…

Derivatives are split in different categories: ETD, OTC cleared and OTC uncleared. The meaning of “LIBOR” in each of those categories is different and is also different from LIBOR fixing. This usage of the same name to describe different things is the source of the confusion in the post’s title.

Note that this usage of “same name; different things” description is fundamentally different to the

Mathematics is the art of giving the same name to different things.

Henri Poincaré

Poincaré meant different things with the same properties, to which similar truths can be applied. Here we have things that should be the same in a decent world but have different properties and to which different (legal) truth apply.

LIBOR fixing in USD have ceased as of 30 June 2023 (not really ceased, but that will discussed later).

The ETD derivatives went through a forced (arbitrary) conversion well ahead of the milestone date (on 14 April 2023 for CME). They have completely disappeared and are not the subject of this post.

The OTC uncleared derivatives are mainly traded under ISDA master agreement. We discuss only those here. The derivatives traded before January 2021 had uncertain fallback mechanisms under the ISDA definitions, or more exactly, there is a certain fallback mechanism (call 4 baks for indicative LIBOR quotes) but it is certain that the mechanism cannot be implemented in practice. Some of those derivatives have been transferred, through a protocol mechanism, to fall under the post January 2021 definitions; this case is described below.

The pre January 2021 do not yet have a legal issue, because LIBOR fixing still exists! This may seem in contradiction to the post title that claim an absence of LIBOR fixing; but again this is a contradiction only because the same name is used for different things (again not in the Poincaré sens). Maybe we will be in trouble with EU Digital Service Act (DSA) that may try to censure this as “disinformation” or “misinformation”!

The “true” LIBOR, representing the interbank lending rate, as ceased on 30 June 2023. But a “fake” LIBOR fixing has been imposed by the regulator, the FCA. This LIBOR is based on an arbitrary formula replacing the market based definition in use since 1986. The regulator imposing an arbitrary definition for a critical benchmark is possible thanks to post-Brexit change of the UK BMR regulation, in particular Article 23A. That change gives the super-power to the regulator to change a benchmark definition. If tomorrow you see that the temperature in London 20 degree Celsius for the while month of the December, this is most likely not a result of the climate changes but a result of the FCA decision to change the meaning of “temperature”. This “fake” LIBOR should stop on 28 March 2024. We will only see then the true legal impact of the transition on USD LIBOR OTC derivatives (and bonds, and loans, and structure products).

The post January 2021 trade do not have a problem either, because ISDA forced a “non-representative” clause in the new definition. The LIBOR trade do not reference LIBOR anymore, even if LIBOR still exists. This is because the regulator that have created a new definition for LIBOR have immediately declared that what they have created is not representative of the market it is suppose to represent — while the previous version was representative. Those trades have been converted to SOFR-linked derivatives that are not really OIS (see fallback transformers and subsequent posts). Unfortunately, there is no detailed public information about the volumes of those; we can not report on it.

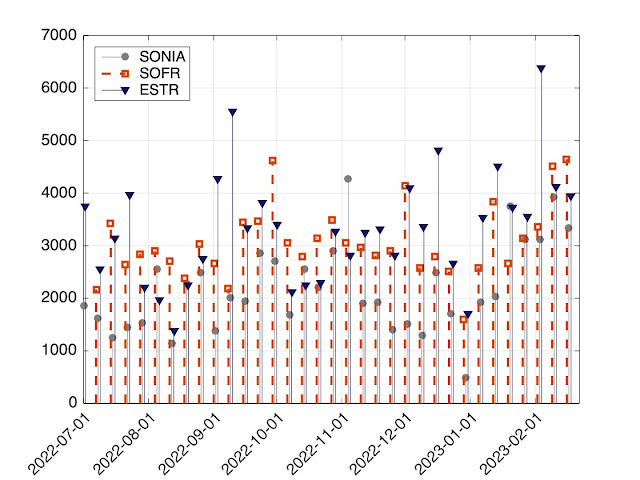

We come to the next type: OTC cleared. For that category, some data is available and we describe below some figures from LCH.

The existing LIBOR swaps have been converted to SOFR swaps. The conversion has been done but spliting the existing swaps in 2, one LIBOR part that continues to the last payment of the LIBOR fixed before 30 June and the SOFR part that starts after that. That conversion has been done mid-May 2023. Since that date, the outstanding LIBOR swaps have decreased from 48 trillions to 273 billions. The decrease is almost linear from the amount on the conversion date to 0 three months later. Most of the LIBOR swaps have a LIBOR-3M benchmark, hence that period. There is a little bit of 6-month tenors and 12-month tenors, so the small residual that continues to disappear.

Swaps linked to LIBOR continue to be cleared at LCH. From 3 July 2023 to 13 October 2023, roughly 400 billions of USD-LIBOR swaps have been cleared. Those swaps are most probably coming from USD-LIBOR swaption with physical exercise. This is a non-negligible amount for a non-existing benchmark. Those swaps are immediately converted to SOFR and do not enter into the outstanding amounts described in the previous section.

If we look at the total outstanding amount in USD, it decreased only by 9.3 trillions over the period, even with the 47.7 trillions of LIBOR swaps disappearing. This is somehow expected. The LIBOR swaps converted to SOFR-linked swaps are not standard OISs. So no direct offset between the converted swaps and the standard one is possible. It would be possible to eliminate them with some compression cycles, but not all participants are part of the those cycles.

Note that GBP, JPY an CHF LIBOR swaps (also coming from swaptions) are still cleared 22 months after the discontinuation of their respective LIBORs. The amounts (in USD equivalent) are GBP 1.330 billions, JPY 4.54 billions and CHF 0.17 billions.

There is also 13 trillions of outstanding basis swaps. With the disappearance of LIBOR, those basis are certainly SOFR v EFFR. The US SOFR RFR adoption indicator for September is down to 68.3% from 76.2%, another sign that EFFR is still playing an important role in USD derivatives.

The short conclusion is that LIBOR transition is still in progress even in the absence of LIBOR!