We are now 7 weeks into 2023. Where do we stand in term of USD rate benchmarks?

LIBOR volume continue to decrease significantly. At LCH, it represent less than 30% on a weekly basis with the last two weeks even below 10%.

As reported in our recent post on USD Benchmarks: the winner for 2022 is ... Fed Funds!, Fed Funds dominate the USD landscape in nominal terms — not in DV01 weighted terms.

Figure 1: Weekly share by product types at LCH

If we look at the oputstanding amounts, the order has not changed for a year or so, with in decreasing order LIBOR-SOFR-EFFR. SOFR is closing the gap to LIBOR; LIBOR is around USD 60 trn down from more than USD 80 trn while SOFR is up to more than USD 55 trn from less than USD 20 trn a year ago. EFFR is around USD 25 trn. It seems that we approaching the date where SOFR will be above LIBOR. That date will be the final "SOFR First" date.

Figure 2: Outstanding amounts by benchmarks at LCH

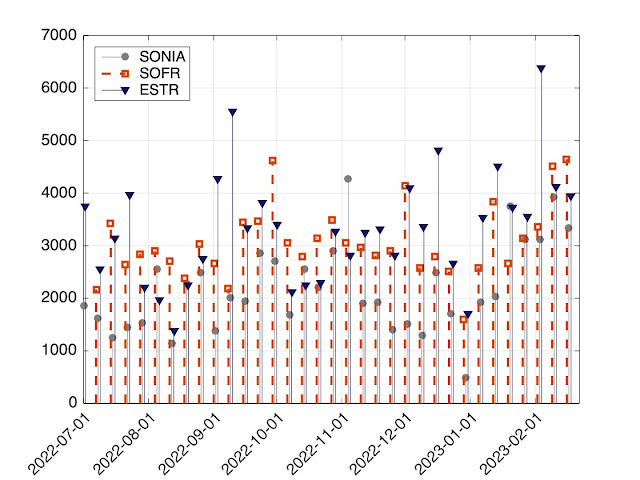

We can compare the USD-SOFR derivartive volume to GBP-SONIA and EUR-ESTR. Obviously they are in different currencies and GBP and EUR attrach significantly less derivative volume in general. But the comparison is interesting as the difference in volume terms in not large. ESTR is even above SOFR in most of the weeks, except the last two weeks. For GBP, SONIA is the only significant benchmark. For EUR, there is still EURIBOR, without plan to stop it and ESTR as unique overnight benchmark. In USD, the situation is more complex with USD-LIBOR that is planned to stop in June 2023, and two liquid overnight benchmarks EFFR and SOFR — plus other less liquid benchmarks like AMERIBOR and BSBY.

Figure 3: Comparison between volume of GBP-SONIA, USD-SOFR and EUR-ESTR at LCH.

This shows that there is still some room before SOFR becomes the really dominant benchmark in USD rate derivatives.