In a previous blog, titled

Fallback transformers: gaps and overlaps we have described the (unintended?) consequences of the offset mechanism in the IBOR fallback computation period described in the Bloomberg

IBOR Fallback Rate Adjustments Rule Book.

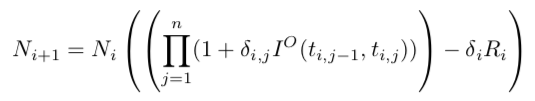

From the fallback rule book, does it transpire what the graph below represents? If not, continue reading!

Figure 0. Overnight weights to be explained.

The proposal for the period is to offset the overnight compounding period start with respect to the IBOR period start by two (business) days and to compute the overnight compounding period end as the IBOR tenor after the start (in the modified following convention). As very well known by practitioners, the period additions in finance are neither commutative nor additive — saying that addition is not additive sounds very strange, but period addition is not really an addition. All the back and forth on dates to define the compounding period necessarily lead to "not text book consequences".

One of the consequences, that was demonstrated on an example in the above mentioned blog, is the gaps and overlaps in the overnight coverage generated by the fallback. A natural questions from blog's readers and clients is to know how prevalent this effect is among a 'normal derivative book'. It is difficult to decide what a 'normal derivative book' is but we can generate books covering all dates and see what happens. This blog extends the analysis initiated in the previous blog by looking at the effect on a book consisting of 251 swaps with effective date in each business day of 2020. The swaps are USD fixed (semi-annual bond basis) versus USD-LIBOR-1M with a tenor of 2Y. This means one year in which the book builds up, one year in which it is stable and one year in which swaps come to their maturity.

We have three versions of the book: the original LIBOR book, the book after the fallback (in this case considering that the fallback applies as of start of 2020) and a book of OIS with the same effective dates as the fallback swaps start compounding and using similar conventions (same fixed leg as the fallback leg, SOFR compounding with monthly payments on the floating leg). The valuation date is 2019-10-04. The exact valuation date does not really matter, as long as it is before the start of the first swap. The notional of the swaps are USD 10,000.

Like in the previous case, the first step is to look at the daily PV01 of the floating legs.

We start with the simpler case, the OISs. All the composition periods are perfectly aligned and the risk is what you see in any text book: a risk at the start (in one direction) and a risk in the end (in the other direction). The risk is proportional to the time to cash flow. At maximum in our case, the maturity is a little bit beyond 3 years from valuation, so the PV01 is around USD 3 per swap. Due to non-good business days, in some cases two or three swaps mature on the same date and the PV01 in those dates in around USD 6 or 9. This is represented in Figure 1.

Figure 1. Daily PV01 for the portfolio of OISs.

In Figure 2, we present the same graph but with a scale 10 times smaller. This is not a display error, but this is to be able to compare with the other cases later.

Figure 2. Daily PV01 for the portfolio of OISs. Different scale.

We move to the fallback case. According to some descriptions in text related to the transition, the fallback generate risks similar to OISs and should not create any risk management issues. When we apply or daily PV01 to the generated book, we see the risk displayed in Figure 3. The scale of figure 3 is the same as the one in Figure 2. Very large risk, one of them larger than 100 appear. Note that to obtain such a risk, we would require a 100-year tenor swap, 30 swaps with 3-year tenor or a swap with notional USD 300,000 instead of USD 10,000. This the maximum risk, but there are also many days with risks above 50. The risk profile is clearly distinct from the one of an OIS book.

Figure 3. Daily PV01 for the portfolio of swaps after fallback.

For the third book, the LIBOR book, the daily risk is displayed in Figure 4. There are also spikes of daily risks. Even if LIBOR is the main benchmarks for interest rate derivative, this representation of the risk is probably not familiar and certainly does not appear in most text books. The origin of this risk is again the issue with adjustment for non-good business days. The LIBOR periods do not correspond exactly to the swap accrual periods and payment dates.

Figure 4. Daily PV01 for the portfolio of LIBOR swaps.

This risk has been present for as long as LIBOR swaps have been traded. In term of size, the sum of absolute values of all the risk after fallback is about twice the sum of absolute value in the LIBOR case. But, and maybe more importantly, the LIBOR fixes in advance and those daily sensitivities have an impact only in term of the expected rates over those periods. In the case of SOFR, the composition is in-arrears, so the impact is not on the expected value, but on the realized value which is a lot more volatile. Not only the fallback PV01 are larger but they apply to the more volatile realized rates and not to the smoothed by expectation LIBOR rates. The LIBOR has not only an effect of average by accumulation of days over a tenor but also an average effect of expectation.

The graphs reported up to now do not correspond to the standard representation of risk on a trading desk or in a risk management system. The most used representation is as market quote bucketed PV01. We propose those representation below for the fallback and OIS portfolios where we have changed the notional of each swap to be 1,000,000 USD. As can be seen, the difference is very small. In total, there is around USD 1 difference over an almost USD 50,000 risk; the largest difference on any bucket is USD 42. No market maker would hedge the USD 42 risk, but would a market maker look at a USD 10,000 systemic daily risk - which is the maximum risk reported above for the fallback portfolio?

Figure 5. Bucketed PV01 for Fallback and OIS.

It is also important that those daily risk are not appearing randomly because of large trades in the book, they appear systematically because of the vagaries of the calendar. In a calendar with all months of 30 days and weeks of 10 days, those issues would not appear. Maybe the

French Republican Calendar should be reinstated to facilitate the LIBOR fallback!

The risk has been displayed as set of daily PV01. Can we also represent the weight of the different days? If the risk is not uniform, it means that some overnight periods are more important than others. What are those periods and what is the size of those under and over-weights? This is represented in Figure 6. For the fallback and OIS portfolios, we have represented the weigh of each overnight period in the 3-year period. The OIS representation is very clean, days weights increase as we add trades in the book, stay constant at 251 (the number of trades) for a year and decrease smoothly after. The representation for the fallback portfolio (in red) is a lot more chaotic. If we look at the middle year, there are many days with a weight of 251, but there are also many days with weigh well below and well above that level. The maximum weight is 292 on 2020-12-23 — this is 41 more than in the OIS case or 16% more — and the minimum weight is 211 on 2021-03-24. Hopefully nothing bad will happen to SOFR on those dates. You can find other interesting dates: a weight of 282 on 2020-12-24 — i.e. over a 3 day Christmas week-end — or a weight of 227 on 2020-01-29 — i.e. over a 3 day month end.

Figure 6. Portfolio daily overnight count for Fallback and OIS.

Now that this Christmas tree-like has been interpreted, does what it represents transpires to you from the fallback rate adjustment rule book? If not, maybe it would be beneficial for you to discuss all those elements with professionals that have investigated them and many others minutiae for several years.

All the graphs and figures reported in this blog have been obtained using production grade code and market data. The fallback trades are produced using

Fallback Transformers tools and libraries developed since 2018.

Contact us for more details about those tools.

- Fallback transformers - Introduction

- Fallback transformers - Present value and delta

- Fallback transformers - Portfolio valuation

- Fallback transformers - Forward discontinuation

- Fallback transformers - Convexity adjustments

- Fallback transformers - magnified view on risk

- Fallback transformers - Risk transition

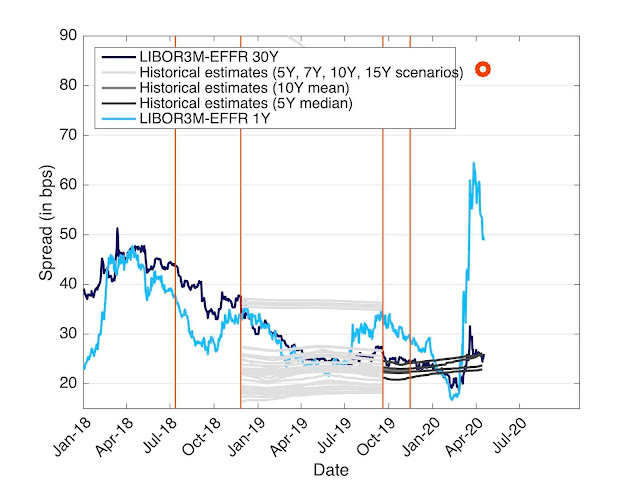

- Fallback transformers - Historical spread impact on value transfer

- Fallback transformers - A median in a crisis

- Fallback transformers - Gaps and overlaps

Don't fallback, step forward!

Contact us for LIBOR fallback and discontinuation: trainings, workshops, advisory, tools, developments, solutions.