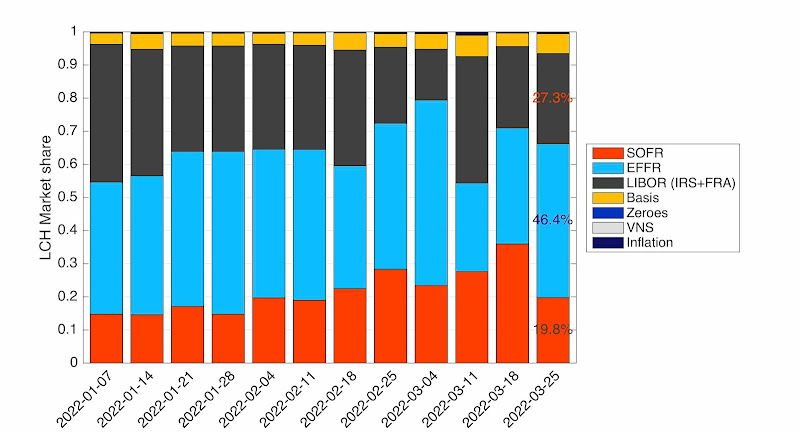

Finally, 5 years after the "The future of LIBOR" speech, 1 year after the death date announcement, more than 6 months after regulators "SOFR First" announcement, we have reach the first step in "SOFR First". "SOFR First" is for the first time a reality in LCH cleared weekly volumes. The SOFR first is still very partial as it does not appear in ISDA/US regulatory or in CME futures figures.

On LCH side, SOFR is first with 36.0%, EFFR second with 35.0% and LIBOR third with 24.6%. SOFR has a relative majority, slightly above one third of the volume but still far from an absolute majority. On the US regulatory figure, outright SOFR is 42.4% of a total that does not include EFFR (not reported in ISDA figures). The change of volume share is mainly due to the decrease in LIBOR and EFFR volume; the SOFR volume is practically unchanged over the last 5 weeks.

Figure 1: Weekly share of product types at LCH

Last week also saw the launch of the ICE Term SOFR Reference Rates. There was already a SOFR Term rate, administered by CME, but to our opinion that benchamrk is less convenient. The CME benchmarks are based on futures prices and obtained through some arbitrary intepolation mechanism and some weighted average over the day while the ICE benchmarks are based on actual market prices for the given tenors at a given point in time.

This lead to Figure 2, where the volume of SOFR swaps and its split by tenor is displayed. We can see the trend already mentionned in previous blogs (e.g. here) which is that with respect to other overnights benchmarks, the share of short term swaps is relatively low. The volume in the USD OIS short term market is mainly in EFFR-OIS. The liquidity is not there yet to use level 1 inputs in the benchmark waterfall. Level 1 inputs are "eligible, executable prices and volumes for relevant and eligible overnight interest rate swaps referencing the relevant RFR, provided by regulated, electronic trading venues". For the moment only Level 2 inputs, i.e. "eligible dealer-to- client prices and volumes".

Figure 2: SOFR volume evolution and share among tenors.

The outstanding volume continue to decrease slighlty for LIBOR and increase for SOFR.

Figure 3: LIBOR, EFFR and SOFR outstanding volumes at LCH.

On the futures side, we are still far away from SOFR First. LIBOR is still the dominant force, both in terms of daily volume (Figure 4) and open interest (Figure 5). Over last week the market share at CME was LIBOR-3M at 53.7% (2.4 m ADV), SOFR-3M at 32.7% (1.5m ADV), EFFR-1M at 11.4%, SOFR-1M at 2.2% and BSBY at 0.1%. There has not been a single day where SOFR-3M volume was above LIBOR-3M volume. On the futures side, we are still waiting the "SOFR First" first day. On the one month contracts, EFFR is well above SOFR-1M, a market feature parallel to the swap market where short term EFFR-OIS dominated SOFR-OIS.

Figure 4: Daily futures volume at CME.

The open interst is almost unchanged for LIBOR since the start of the year, with only a small dip on 15 March with the expiry of the March contracts. The SOFR-3M open interests continue to increase and also dipped at mid-month (on 17 March, due to a different expiry mechanism).

Figure 5: Futures Open Interest at CME