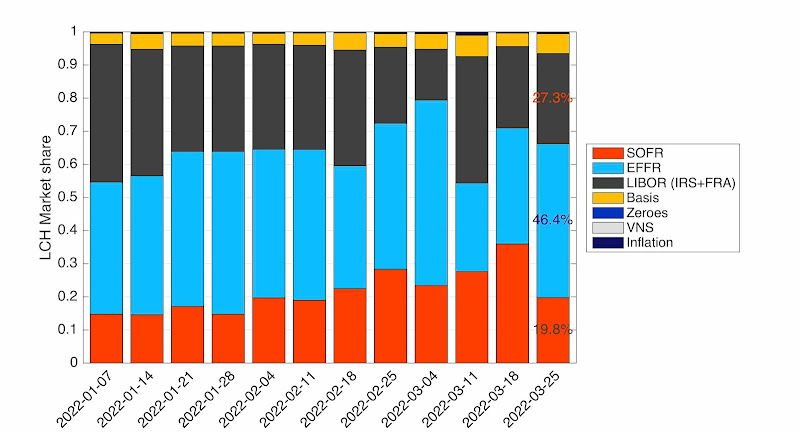

Last week we reported the first "SOFR First" week, at least in term of volume at LCH. This week we are already back to "SOFR Third" as displayed in Figure 1. The SOFR share fell significantly to 19.8% from 36.0% while EFFR increased to 46.4% and LIBOR to 27.3%. In DV01 terms the shares may be different as a lot of the EFFR trades are shorter term.

Figure 1: Weekly share of product types at LCH

The large changes in share are due to a slight decrease in SOFR trading but significant increase in EFFR and LIBOR trading as displayed in Figure 2. The ISDA/US regulatory figures also display a decrease in SOFR share.

Figure 2: SOFR volume evolution and share among tenors.

In absolute terms for the outstanding amounts, SOFR is also third as displayed in Figure 3. The only slightly positive note for SOFR is the continuous increase in outstanding amounts at LCH while LIBOR outstanding amounts have been decreasing for the last 4 weeks.

Figure 3: LIBOR, EFFR and SOFR outstanding volumes at LCH.