With a couple of weeks left to the LIBOR big crunch, we review the market situation in term of "spreads".

There has been a push to not only correct the LIBOR weakness but also from certain quarter to try to kill the idea of credit sensitive benchmarks. With many trillions of financial instruments referring to credit sensitive benchmarks and LIBOR in particular, the impact of removing the credit sensitivity is, on a gross basis, many trillions multiplied by many basis points, i.e. a huge amount. That huge amount is the so-called value transfer in the transition.

In this blog we don't try to estimate the "many trillions" part, but to review with actual market data the order of magnitude of the "many basis points" part.

The USD market is both the largest financial market and the one where more benchmarks related to those issues are publicly available, so we focus on that market.

Some of the available benchmarks are:

- SOFR: Secured Overnight Financing Rate, a secured overnight rate published by the New York Federal Reserve.

- LIBOR: London InterBank Offered Rate, and unsecured term rate published by IBA. Its CHF, GBP, and JPY version will stop publication on 2021-12-31. Its USD version will stop publication on 2023-06-30, but to some extend its use for new trades will be forbidden as soon as 2022-01-01.

- AMERIBOR: There are several version of it, and here we focus on the 30-day term rate with ticker AMBOR30T

- Bloomberg BSBY: Credit sensitive term benchmark based on actual bank funding transactions.

- IBA BYI: Bank Yield Index. To some extend similar to BSBY but only in beta version at the moment.

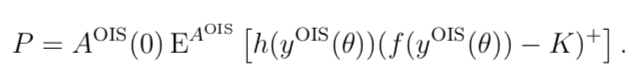

LIBOR rates have been accused to be manipulated, probably with reason in the first 10 years of the millennium. If manipulation was the problem, one could simply have reformed them instead of discontinuing them. Are LIBOR rates still manipulated? Figure 1, tends to lead to a "no" answer. It displays LIBOR and different other indices, most of them IOSCO principles and BMR compliant, that promise to represent the same bank cost of funding. Through the recent Wuhan born pandemic and Fed provided liquidity flooding, the appearance is the same: the different indices are at very similar levels and move in sync. No sign of major manipulation is visible.

Figure 1: Historical data for different spreads.

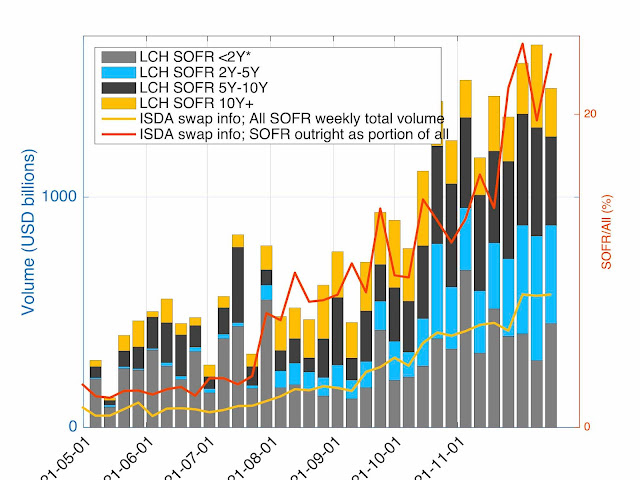

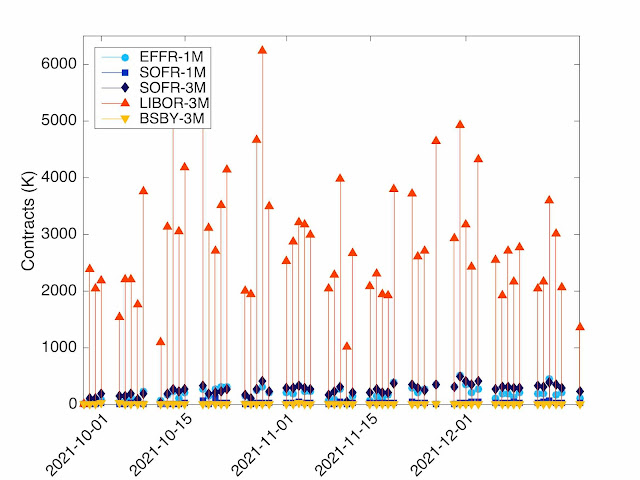

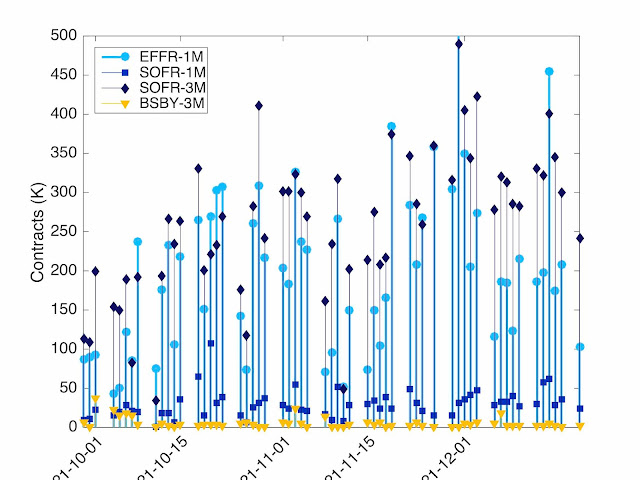

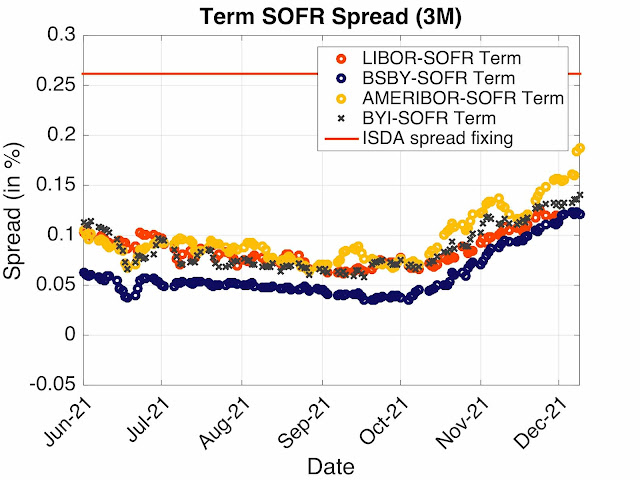

To deal with the forced LIBOR disappearance, an artificial fallback mechanism has been created. It relies on a fixed spread between some measure of SOFR on the LIBOR tenor and LIBOR itself. That spread is fixed and unique for each LIBOR index. What has been the behaviour of the actual spread in the market over the last years? All time series represent the spread between the above mentioned indices and term SOFR. The ISDA proposed spread, copied by CCPs, regulators, and lawmaker is displayed in red. Both in case of crisis and the recent data, this fixed spread has been far away from a bank funding level fair representation.

In Figure 2, we focus on the last 6 months. The proposed spread has clearly been 10 to 15 basis points too high. Actual lending have reflected this reality, with spread to SOFR well below LIBOR spread if the artificial spread is used as a reference.

Figure 2: Historical data for different spreads, last 6 months.

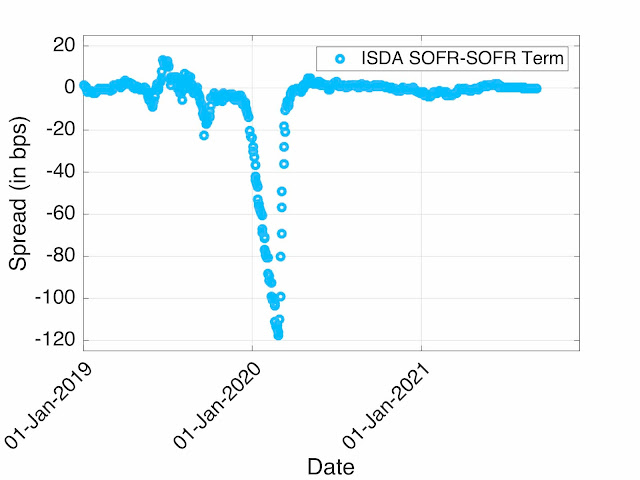

The spread has been computed as the 5-year median between LIBOR in advance and SOFR in arrears. So it includes the credit/liquidity term spread but also the in-arrears/in-advance spread, i.e. the misestimation by the market of the short term (next 3 months) monetary policy. The impact of that misestimation is displayed in Figure 3. The pandemic induced rate cut has created a significant (up to 120 bps) misestimation; that misestimation is embedded in the computed spread.

Figure 3: Historical data for the spread between ISDA SOFR 3-month methodology and ARRC recommended SOFR 3-month term rate.

Is this analysis relevant or just a theoretical computation without practical impact? This spread is used for 100 trillions of financial products. From a risk management point of view, the important figure is Figure 1. The change of benchmark impairs the risk management features by as much as 100 basis point, certainly a non-negligible level. For some this may be an improvement, but certainly it is not an impact-less transition. From a valuation perspective, the important point is the expected value of the changes. The spread as been computed as median — not a mean —, so there is no a priori relation between the figure used and the actual valuation impact, even if the spread figure was computed properly. In practice the difference is, for USD-LIBOR-3M, a median of 26.161bps ("official" figure) and a mean of 32.583 bps. That is more than 6 bps between the two. If the "technical" choice done by ISDA and its member had been "mean", you would be richer (or poorer) by 6 bps on all your USD-LIBOR-3M payments for the rest of times!

In between the "wrong" rate (in-advance/in-arrears) and the wrong statistical measure (mean/median) there is a lot that can go "wrong" from a value transfer perspective. Looking at the issue from different perspectives, you can certainly find different answers. But in all cases, a realistic order of magnitude is around 10 basis points.

All those issues do not stop on 1 January 2022. The impacted trades may stay in the books for many years or may have been amended in an unfair way. Some items to keep in mind:

- the management of the fallback process is extremely complex, even with a fixed spread (see here),

- the spread fixing mechanism/protocol may have been done incorrectly and you need to claim some compensation (see here)

- the impact on non-linear products is more complex than a simple spread change (see here)

- EU regulation forces the use of "in-advance" fixing for CHF LIBOR, with potentially significant convexity adjustment impacts

- CCP transition is not equivalent to bilateral transition, back-to-back trade may not be back-to-back anymore

This is only a small list of potential issues. Don't hesitate to contact us for advice on those and related issues. Better safe than sorry; a couple of days worth of advice can save you years and millions in litigations or financial losses.