Over the last 5 months, several "SOFR First" dates have been initiated by US regulators. With the January 2022 date approaching, this post review were we stand on this issue for the two main source of liquidity in the interest rate market: swaps and futures.

The post is based on public data from LCH, ISDA and CME for futures.

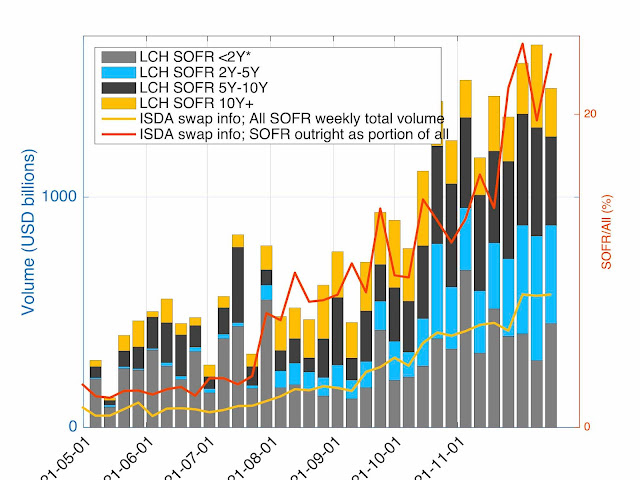

On the swap side, the SOFR portion in volumes continue to increase. The volume is now above 1,000 billion a week every week. But the increase is not spectacular. From the ISDA figures, it appears that a couple of weeks before the theoretical deadline, we are roughly at LIBOR 75% - SOFR 25%.

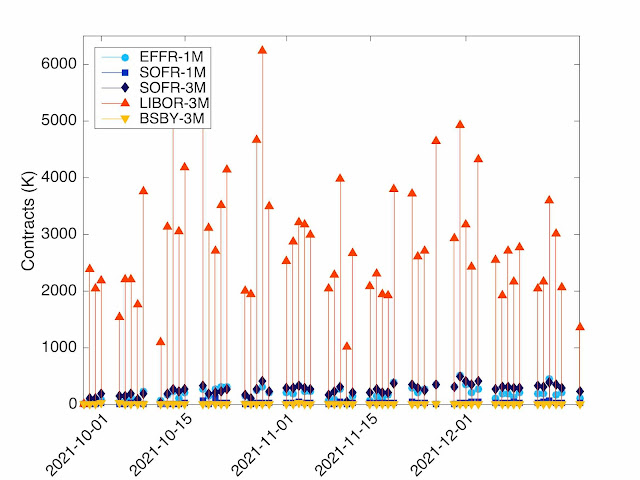

On the futures side, the transition is even less spectacular as reported in Figure 2. There the situation is (over the last month) LIBOR 83% - SOFR 10% - Fed Fund 7%.

From our perspective, it is difficult to understand where this is coming from as by trading futures with maturity beyond June 2023, one effectively trade a SOFR futures under a different name. A financial reason that may warrant such trade is the expectation that the transition will not take place and hope for a larger/smaller spread that the one implied by the CME announced conversion mechanism. But such an explanation for a so large volume does not appear realistic. Maybe a more down to hearth explanation is that the market is not ready from a system, back office, validation or limit prespective. The users trade LIBOR futures, even if they are convinced that they are SOFR futures under another name, because they are not allowed to trade SOFR futures directly.

The slow transition of the eurodollar futures as been also reported in the press. See "SOFR First" for Eurodollars downgraded to "best practice".

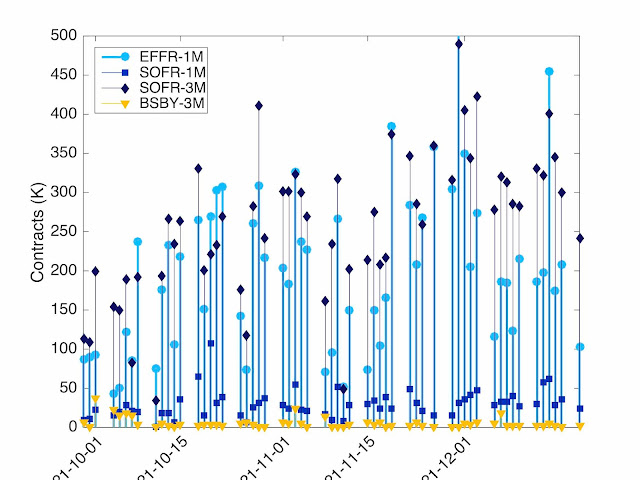

Even for overnight futures, the SOFR futures are not the only player as reported in Figure 3. The Fed Fund futures still trade in a large volume. On the one-month futures side, the Fed Fund futures volume is well above the SOFR futures.

The futures graphs also provide some figures for the BSBY futures. The volume is present, but an order of magnitude or two below the SOFR futures (0.1% of total futures volume in the last month). This reinforce our opinion that the continued trading of LIBOR futures is a sign of lack of market readiness in the transition. Trading of LIBOR futures is not trading bank funding, that would be better done through BSBY futures; trading of LIBOR futures is not trading monetary policy, that would be better done through SOFR futures. What appear to be traded in LIBOR futures is the "inertia" of the market, the difficulty inherent in changing or discontinuing something that has been at the core of the interest rate market since the 80's.