Last week, we were saying "SOFR: slowly getting to SOFR First"; this week it seems we have to take that back. This week title is LIBOR transition:: Back to LIBOR first - again and again!, as reference to the "LIBOR Transition: Back to "LIBOR First" - again!" post from one month ago. The reason is the same, LIBOR appears very sticky. Each time the market seems to definitively move to SOFR first, LIBOR comes back with a vengeance and take over again.

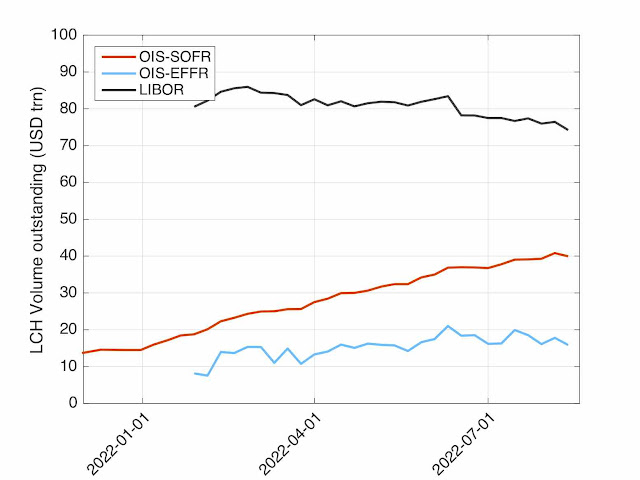

Figure 1: Weekly share by product types at LCH

The LIBOR return is visible both in LCH numbers displayed in Figure 1 and in ISDA-US regulatory numbers visible in Figure 2. In both cases, the weekly volume for LIBOR is above the weekly volume for SOFR.

Figure 2: Weekly SOFR volume at LCH and as reported by ISDA (US regulatory figures based).

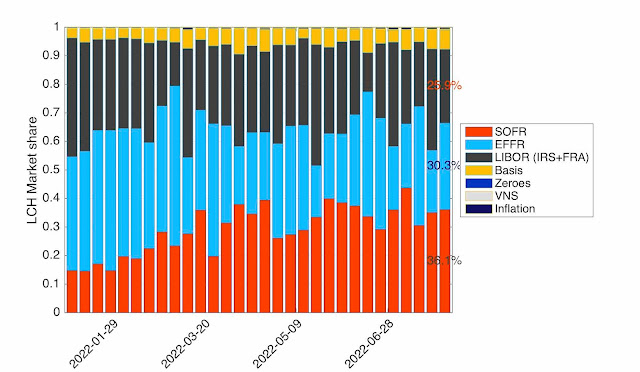

At the outstanding amounts level, the picture is not very different. Over last week, outstanding LIBOR amounts have increased (slightly). The LIBOR volume is far from being "risk reducing". The outstanding SOFR volume is below its peak from 2 weeks ago as visible in Figure 3.

Figure 3: Outstanding amounts by benchmarks at LCH

More than 5 years after the "Future of LIBOR" speech, almost 18 months after the announcement of the definitive LIBOR dismissal and more than one year after the SOFR First announcement; LIBOR is back to the forefront.