A quick look at the OTC and ETD sides of SOFR for the second week of 2022.

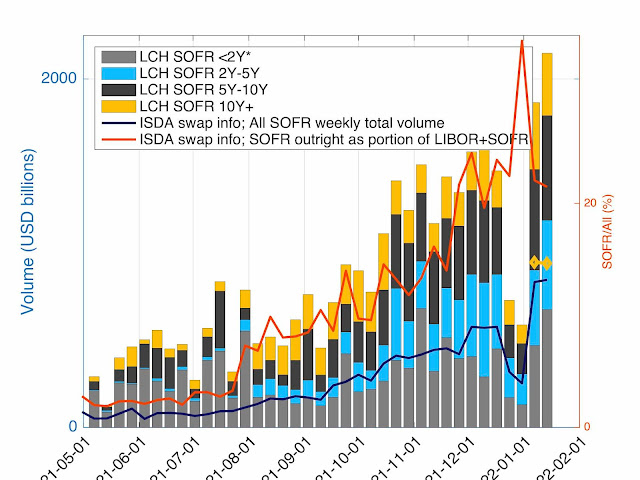

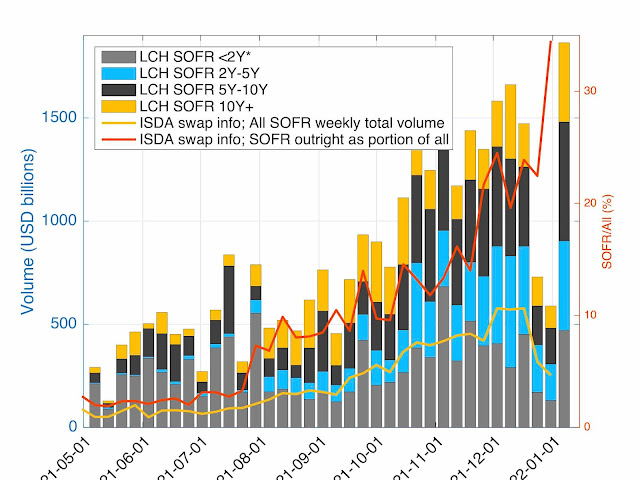

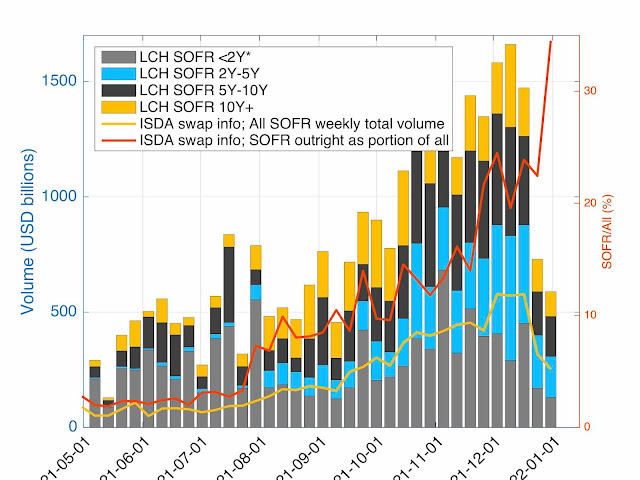

The OTC Cleared at LCH side still reports a "SOFR Third" week. The major change since last week has been the change in First, now going to EFFR slightly ahead of LIBOR. SOFR's share has slightly decrease from 14.8% down to 14.6%. The figures are: OIS-EFFR 41.9%, IRS-LIBOR 37.7% and OIS-SOFR 14.6% (plus some basis, FRA, inflation). We have added the SOFR share at LCH in Figure 1 as the yellow lines (only for 2022 as we have not collected the relevant data in 2021).

Note that the ISDA figures report only LIBOR and SOFR (in particular not EFFR) and is based on US regulatory figures, which is well below LCH figures (dark blue line in the graph, around 30% of LCH volume). The SOFR share around 20% reported by ISDA is inflated due to the absence of the EFFR volume.

Figure 1: OTC SOFR volume and share of SOFR

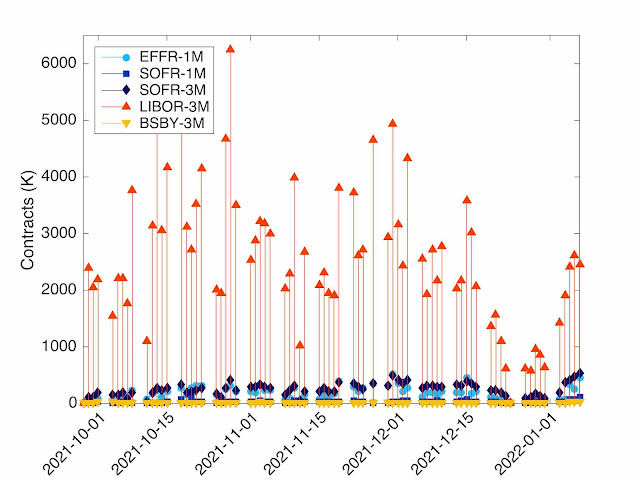

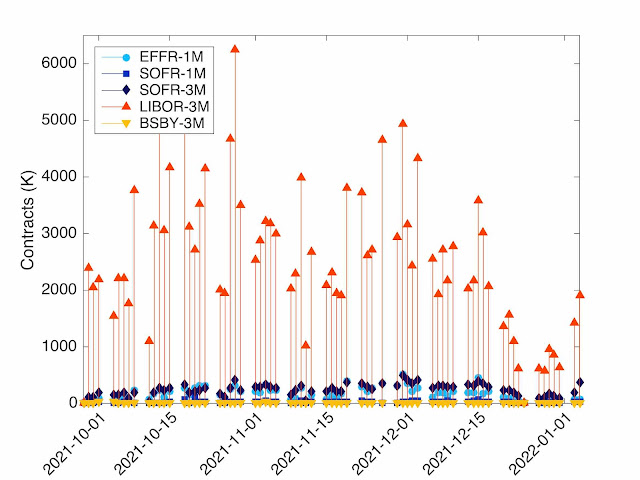

On the STIR futures at CME side, there is a "shift in liquidity", but still very slow. The figures are LIBOR-3M 69.7%, SOFR-3M 18.5%, EFFR-1M 9.4%, SOFR-1M 2.2%, and BSBY-3M 0.2% as displayed in Figure 2. The open interest for ED has increased by 235K since 31 Dec (from 11,237,037 to 11,472,753), so the ED volume is not "risk reduction". The shares in volume have to be compare with previous shares; if we look at the December figures, we had LIBOR-3M 81.3%, SOFR-3M 10.8%, EFFR-1M 6.5%; SOFR-1M 1.1%, and BSBY-3M 0.2%. Like in the OTC case, the increase in EFFR share is interesting. The "shift in liquidity" is from LIBOR but not all to SOFR, as a large share of the shift goes to EFFR.

Figure 2: Daily STIR futures volume at CME

Some news in other currencies at LCH:

EUR:

EURIBOR still largely dominant with EURIBOR (IRS+FRA) at 79.1% and ESTR-OIS at 18.5% (plus some basis and inflation).

GBP:

Still some LIBOR trades (from swaption exercise), but now at 0.02% of the market! SONIA at 95.7% and inflation at 4.2%.

See also our post related to the 2022 first week: First week of 2022 at LCH - another "SOFR Third" week.