2021 came to an end. What about LIBOR and SOFR?

SOFR certainly did not come to an end. The volumes continue to increase. LIBOR did not come to its end either. On the week before its announced demised, it still dominate the USD interest rate market.A couple of days ago, we published some figures for the USD STIR futures at CME. LIBOR was still around 80% of the market and SOFR coming second with around 14%.

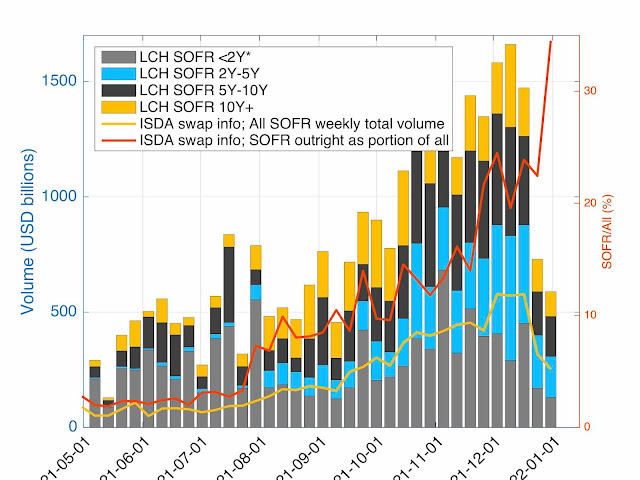

LCH and ISDA have now published their numbers for the last week of 2021.

As expected, over the last 2 weeks of the year the general transaction volume was a lot lower than in the previous weeks. This is reflected in both LCH and ISDA figures. On a relative basis, SOFR is now in the ISDA figures (US regulatory figures) at around one third of the market. Still not at the SOFR First mark, but coming closer. It is difficult to assess if this is a US only effect or a global effect.

Early 2022 figures at LCH indicate that OIS (SOFR and EFFR) is around 72% of the market while IRS (LIBOR and BSBY?) is around 23% (the rest is basis, LIBOR-FRA, inflation). The split between SOFR-OIS and EFFR-OIS is not published on a daily basis. We will have to wait the weekly statistics to see it. But there are early indication that this week could be the first week of the real "SOFR First" for the cleared market.