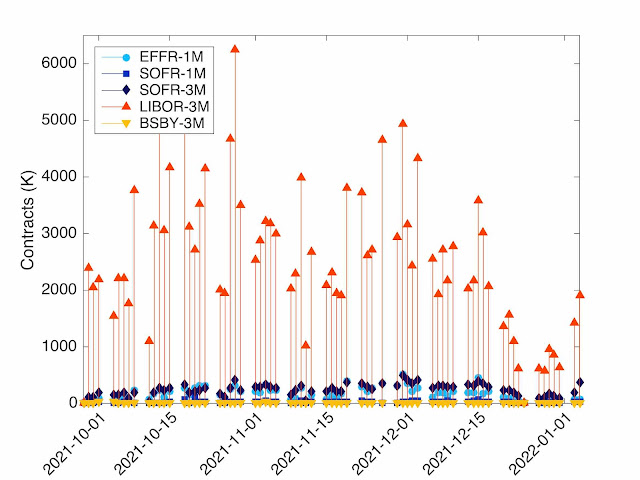

On the STIR Futures side for the first two days of 2022, LIBOR still dominates as shown in the graph below. LIBOR futures are around 81% and SOFR futures (1M + 3M) at 15.5% (the rest is EFFR 3.2% and BSBY 0.2%).

What is interesting also on the LIBOR futures side is that the split between the pre-June 2023 and post-June 2023 is roughly 50/50. Even for the post-June 2023, LIBOR is still the dominant futures, even if LIBOR will not exist anymore at that date. The market prefers to trade LIBOR futures that are planned to convert into SOFR futures to trading the SOFR futures directly.

The transition from LIBOR futures to SOFR futures is far from being trivial from a risk management and model validation perspective. There are at least three elements that should be validated before continuing trading the LIBOR futures with post-June 2023 expiry.

- Fallback: trading post-June 2023 expiry rely on a fallback procedure. The fallback will convert LIBOR futures into SOFR futures with a price adjustment at an uncertain date (the date for GBP-LIBOR futures was mid December 2021). That procedure needs to be validated.

- Convexity: The convexity adjustment between forward and futures is not the same for LIBOR and SOFR futures. In the LIBOR case, there is an extra market quantity, the spread between LIBOR and SOFR (used for forwards collateral); in the SOFR case, the payoff is of Asian type with the final settlement at the end of the period based on some average (composition).

- Tenor: The LIBOR futures are based on LIBOR-3M with standard tenor convention (modified following); the SOFR futures are based on IMM dates and can have tenors between 12 and 14 weeks.

If you are trading LIBOR futures or SOFR futures, maybe a new model validation for the valuation and risk management of those instruments would be appropriate. If this is the case, don't hesitate to contact us. We have researched, published articles and developed related libraries. We can provide a rapid access to the foundations required to the assessment and validation of those market changes.