The title of the post may look like a typo, but it is not. For the first days of the year, among the STIR futures settling against SOFR, the ones with a LIBOR name still dominate. The post-June 2023 LIBOR futures will be converted around June 2023 into SOFR futures (with a known spread of 26.161 bps). The final settlement of those is thus SOFR based, even if they still have a name with Eurodollar LIBOR.

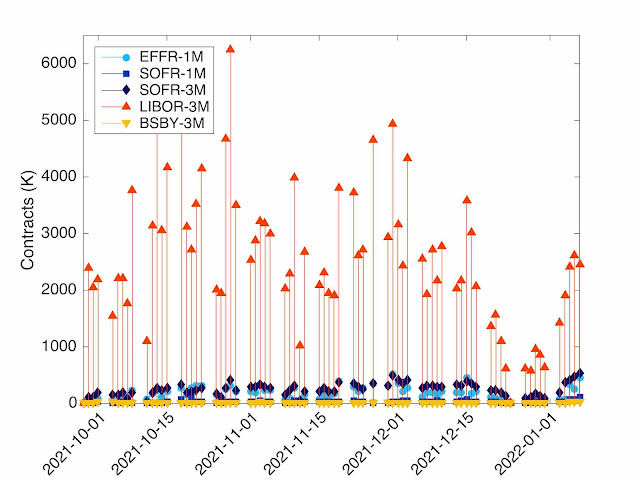

The total volume for STIR futures at CME was for the first week of 2022, 75.1% for LIBOR (3M), 14.2% for SOFR (3M), 8.1% for EFFR (1M), 2.1% for SOFR (1M) and 0.5% for BSBY (3M).

But if we are looking only at the post 2023 futures, they all are SOFR (3M) delivery futures (except a couple of hundreds trades on BSBY). For those trades, the LIBOR futures had yesterday (2022-01-07) a volume of 91.1% (trades up to Dec 2028) and the SOFR futures a volume of 8.9% (trades only up to Dec 2027). Hence the oxymoronic title to this blog.

The LIBOR volume does not correspond to risk reduction as the LIBOR Open Interest have increased by 100,000 contracts since 31 December 2021.

We don't know why such a trading pattern exists, but we conceive that it could be a way to hide the complexity of the new product behind an old name.

Note that on the cleared side, LCH indicates for the first week of 2022 43% IRS (LIBOR) and 57% OIS (SOFR and EFFR). The split between SOFR and EFFR is not published yet but it looks very likely that we are not yet at SOFR First.