One week in the new year. One week where it is recommended not to use USD-LIBOR for OTC derivatives. From the figures published by LCH, this is far from being the case. This is not dissimilar to what is happening with the futures, as described in a previous blog: SOFR Futures: LIBOR dominates!

The OTC derivatives podium, from Gold to Bronze, is LIBOR IRS 41.3%, EFFR OIS 39.8% and SOFR OIS 14.8% (the rest is basis, LIBOR FRA and inflation). Even in the OIS category, SOFR is less than one third of the market.

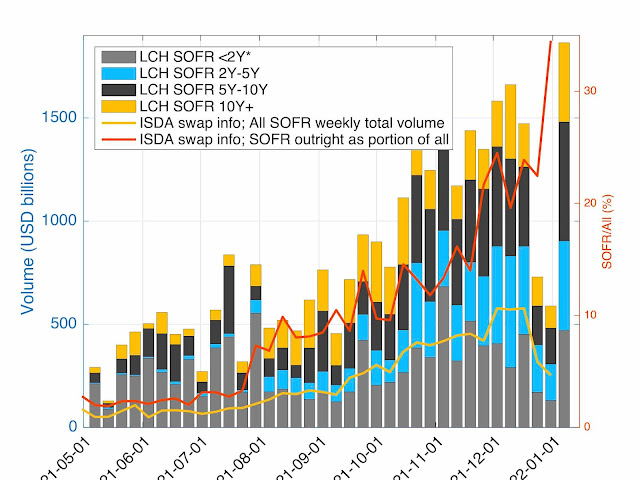

The absolute figures for SOFR are provided below. The ISDA Swap Info for the first week of 2022 was not available at the time of writing this blog.